- Nathan was able to access the Canada Emergency Response Benefit (CERB) and received $2,000 a month during April and May which represents just over 70 per cent of his regular monthly income before taxes. As a result of the expanded eligibility rules announced in April, Nathan was also able to take on a small contract (less than $1,000) mid-May providing haircare tutorials online without affecting his CERB eligibility. Should he require it, Nathan will be able to access the CERB up to a maximum of 24 weeks. Nathan was also able to take advantage of the GST/HST deferral, which provided much-needed cash-flow relief during the initial months of the crisis.

- Emily has been able to receive paycheques thanks to the CEWS program, receiving the maximum of $847 per week. Her salary was funded while she was furloughed and continues to be funded now that she is an active employee through the CEWS. Emily’s employer may continue to be able to access the CEWS until August 29, 2020. Her Canada Student Loan repayments were also deferred beginning March 30, until September 30, which represents savings of, on average, $160 per month.

In addition to the CERB and CEWS income support, Nathan and Emily received a $600 top-up in their CCB payment for May to help support their family’s needs. Combined, these measures provided Nathan and Emily up to $20,152* in financial support between March 15-July 4 to help them through this difficult time.

A Low Income Family of Four

Luc and Jada are a young couple with two young children.

- In mid-March, Luc was laid off by his employer in the construction industry where he was receiving a salary of $700 per week. He was not eligible for Employment Insurance (EI).

- After applying in early April, Luc started to receive income support of $2,000 monthly through the Canada Emergency Response Benefit (CERB). In early May, he received notice from his former employer that his position was being re-instated as of May 11, as the company claimed the Canada Emergency Wage Subsidy (CEWS) to help cover the cost of his salary. The CEWS will subsidize 75 per cent of Luc’s wages upon his return to work.

- During the summer, Jada works part time for a seasonal gift shop to help pay for her tuition and the family’s day-to-day expenses. She was told that the shop would not be opening until later this summer and she is now worried that she may not be able to afford classes in the fall. Changes to the Canada Student Loans Program will help ensure Jada is able to return to school in the fall, since she will receive additional financial assistance, including up to $7,440 in non-repayable grants, which she can use to cover her expenses in September. Further, to help with managing the family’s bills this summer, Jada will be eligible to receive the Canada Emergency Student Benefit, which provides her with $2,000 per month, for any month she is unable to find work between May and August 2020.

The family also received a special GST Credit Top-up payment of $886 in April and their May CCB payment was boosted by $600. These supports provided Luc and Jada up to $13,686* between March 15 – July 4 to help them support their family’s needs and up to $7,440 in non-repayable student financial assistance will be available to help with Jada’s tuition in the Fall.

*Taxes on these amounts are not reflected.

Supporting Seniors

The pandemic has been especially difficult for Canadian seniors—they face the most significant health risks from COVID-19 and have been isolated from family and loved ones in order to reduce their risk of exposure. They are also facing financial vulnerabilities as volatile markets affect their retirement savings. Seniors may have to remain isolated for longer than others and may also face additional expenses, such as delivery service fees. The government has introduced a range of measures to support seniors.

- Providing one-time tax-free payments of $300 for seniors eligible for the Old Age Security (OAS) pension, and an additional $200 for seniors eligible for the Guaranteed Income Supplement (GIS), for a total of $500 for those eligible to receive both OAS and GIS. Of the 6.7 million seniors eligible for OAS, 54 per cent are women, while women comprise close to 60 per cent of those eligible for GIS. Service Canada plans to make the payments the week of July 6.

- Reducing required minimum withdrawals from Registered Retirement Income Funds (RRIFs) by 25 per cent for 2020, in recognition of volatile market conditions and their impacts on seniors’ retirement savings.

- Expanding the New Horizons for Seniors Program with new funding of $20 million in 2020-21 to support organizations that offer community-based projects that reduce isolation, improve the quality of life of seniors and help them maintain a social support network. Additionally, a $9 million contribution from 2019-2020 funding was provided through the United Way to local organizations to support immediate essential services to seniors affected by COVID-19.

- Temporarily extending GIS and Allowance payments if seniors’ 2019 income information has not been assessed. This will ensure that the most vulnerable seniors continue to receive their benefits when they need them the most.

- Providing a one-time special top-up payment through the Goods and Services Tax (GST) Credit in April. More than 4 million seniors benefitted from this measure; eligible seniors received an average of $375 if they were single and $510 for couples.

A Single Low-Income Senior

Laurence is a seventy-year-old single senior. She receives a CPP retirement pension as well as income from a workplace pension, besides OAS and GIS benefits as well as the GST Credit.

- In April, Laurence received $443 from the special GST Credit top-up payment, the maximum amount for a single adult with no dependent children.

- Laurence is taking precautions to avoid exposure to the virus and is isolating. She was able to join phone-based get-togethers with friends thanks to the efforts of a local seniors support group. Another community group has arranged to deliver her groceries a couple of times. The government has provided a $9-million contribution to the United Way, and is providing additional new funding of $20 million to the New Horizons for Seniors program this year, to further support such activities.

- In the week of July 6, Laurence will be receiving $500 from the one-time payment for seniors eligible for OAS and GIS ($300 in respect of OAS and another $200 in respect of GIS).

Taken together, the special GST Credit Top-up payment and the one-time payment for seniors eligible for OAS and GIS will provide Laurence $943 in financial support.

Supporting Vulnerable Canadians

COVID-19 is having disproportionate health, social and economic impacts on vulnerable populations. The government has introduced a series of measures to ensure that vulnerable Canadians have access to the supports they need. These include, for example:

- $157.5 million for community partners to address the shelter and safety needs of people experiencing homelessness, with funding used to help manage or prevent an outbreak in the shelter system.

- $50 million for over 500 women’s shelters and sexual assault centres, to help address the immediate needs of women and children fleeing gender-based violence in cases where home isn’t a safe place. This includes $10 million for the existing network of 46 emergency shelters on First Nations reserves and in the Yukon to support Indigenous women and children fleeing violence.

- $7.5 million for Kids Help Phone to address the emotional and mental health needs of children and youth resulting from the COVID-19 pandemic,

- $100 million to support food banks, and other organizations providing emergency hunger relief, that are facing increased demand for their services. One in three Canadian who are not at work because of COVID-19-related closures are going hungry, according to a May report from Statistics Canada. This funding will be used to purchase food and other basic necessities.

- $350 million in 2020-21 to establish an Emergency Community Support Fund to support charities and non-profits that deliver essential services to serve vulnerable people. 772 projects have been funded as of June 9, 2020.

To respond to the significant challenges that Canadians with disabilities are facing because of COVID-19, as they work to access essential services and care and provide for their families, the government is stepping up to make sure they have the support they need to make it through this crisis.

- Providing funding of $556.7 million for a one-time, tax-free payment for Canadians with a valid Disability Tax Credit (DTC) certificate as of June 1, 2020. The payment will be $600 for such Canadians, and it will be adjusted to take into account the amount received under the special one-time payment for seniors eligible for OAS and GIS.

- Providing new funding of $15 million for the creation of a National Workplace Accessibility Stream of the Opportunities Fund for Persons with Disabilities to help Canadians with disabilities and their employers to improve workplace accessibility and access to jobs.

- Students with disabilities are also benefiting from an extra $750 per month under the Canada Emergency Student Benefit ($2,000 per month instead of $1,250) and doubling of the Canada Student Grants for Students with Permanent Disabilities.

Supporting Indigenous Communities

COVID-19 has further highlighted many existing challenges facing Indigenous peoples, particularly, those who live in remote areas. Indigenous communities are incredibly resilient and have implemented innovative solutions to prevent the spread and manage the impact of COVID-19.

The government has introduced a number of measures to build on community-led solutions and support an immediate public health, social and economic response in Indigenous communities, investing over $1.4 billion so far:

- $380 million for specific distinctions-based support for Indigenous communities, with dedicated funding for urban and off-reserve Indigenous organizations.

- $270 million for the on-reserve Income Assistance Program to address increased demand and help individuals and families meet their essential living expenses.

- $29 million (2020-21 and 2021-22) to help build and operate 10 shelters in First Nations communities on reserve across the country, and two shelters in the territories, to support Indigenous women and children experiencing and fleeing violence.

- $285.1 million to enhance public health measures in Indigenous communities.

- $75.2 million to increase existing distinctions-based support for First Nations, Inuit, and Métis Nation students pursuing post-secondary education.

- $306.8 million to support Indigenous businesses, as well as for operating expenses and liquidity pressures of Aboriginal Financial Institutions.

- $133 million to help Indigenous communities support their local businesses and economies, including support for community-owned Indigenous businesses and Indigenous businesses operating in the tourism sector.

- $17 million to provide interest payment relief for First Nations with existing loans under the First Nations Finance Authority.

Additional information on how the Plan addresses a number of the disproportionate impacts of the pandemic on various groups of people within Canada can be found in the Gender-Based Analysis Plus (GBA+) Summary of the Plan below as well as in Annex 1 of this report.

Delivering Immediate Income Support

Through the Plan, the government has sought to provide generous income support to those most affected by the crisis, while simultaneously creating incentives for safe participation in the labour market.

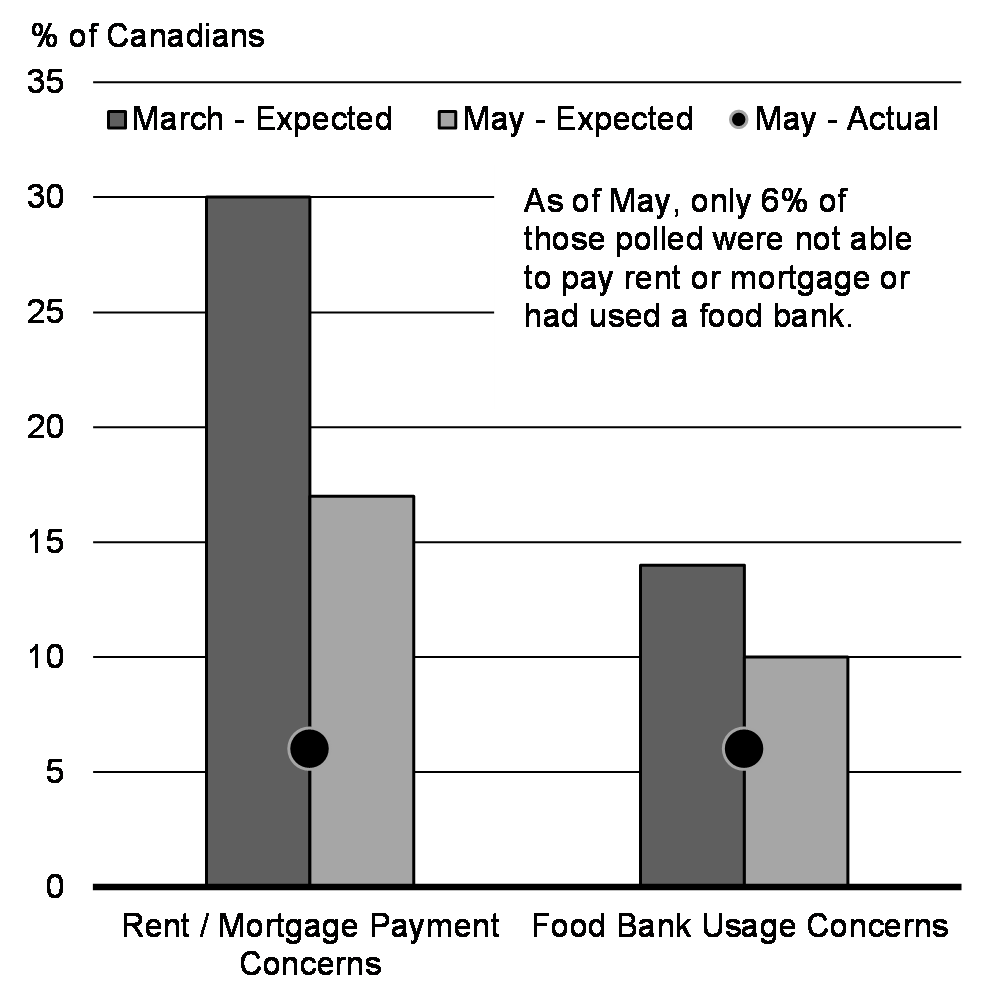

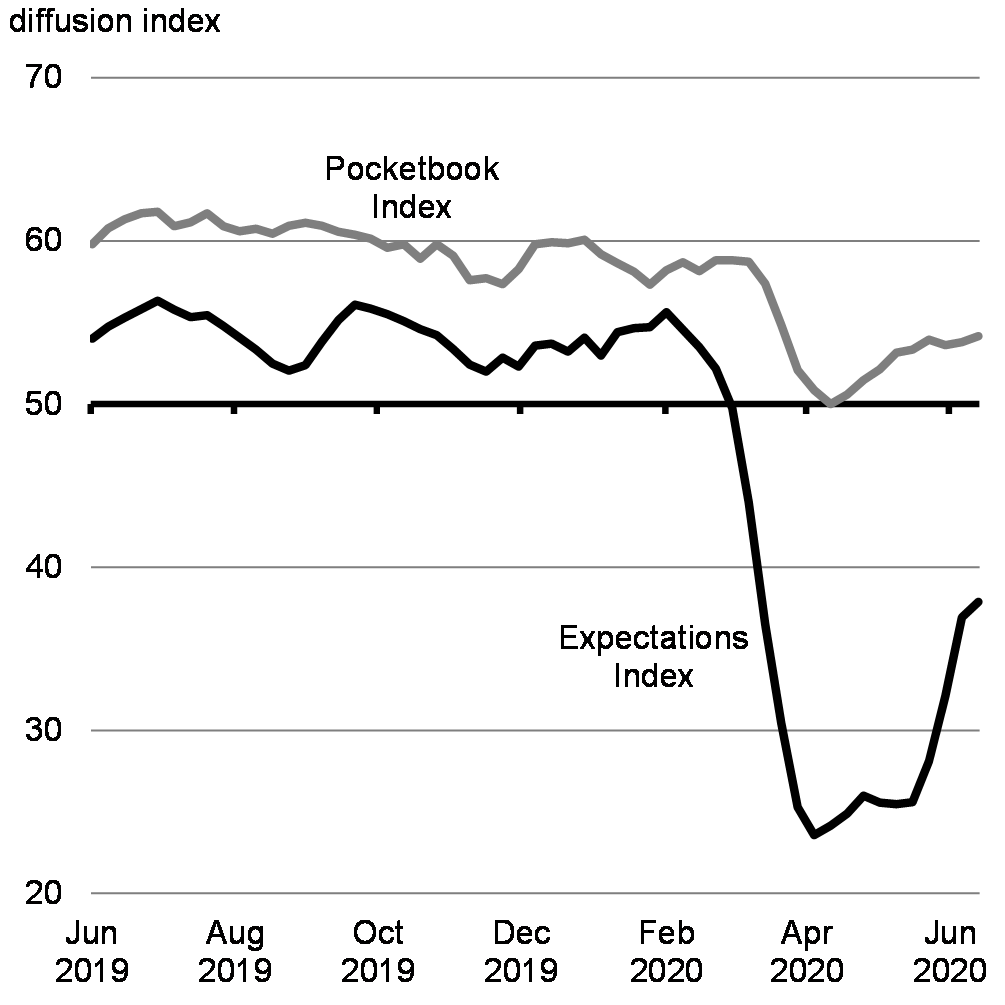

In the months that followed the introduction of the Government’s first response measures, Canadians have been able to access the income support they need and are less anxious about their financial situation than they expected to be at this time (Chart 1.1).

According to a recent survey by the Angus-Reid Institute, 30 per cent of those surveyed in March initially expressed concern over their ability to pay rent or their mortgage. In May, the data showed that this concern had not materialized for the vast majority of Canadians, with 6 per cent having been unable to pay these monthly bills during this period. Further, Canadians expressed increased confidence about an economic recovery, with households feeling relatively confident about their own personal finances.

Chart 1.1

This massive effort to help support households has helped to stabilize the Canadian economy when it was needed most and helped to protect the most vulnerable from the immediate effects of an unprecedented economic crisis.

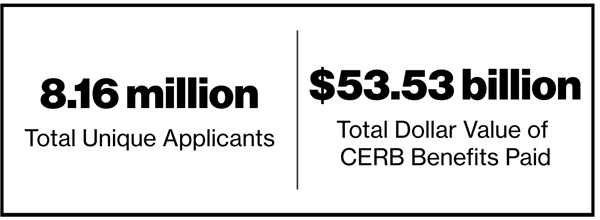

Canada Emergency Response Benefit (CERB)

From the beginning of the crisis, the government recognized that an unprecedented number of Canadians were going to need income support. Unlike many other countries, Canada proactively established new programs to ensure that people who needed it could get simple and timely access to income supports to help cover their essentials.

In mid-March, record levels of Employment Insurance (EI) claims were made. It was clear that the EI system could not handle this sudden surge in volume. There were also hundreds of thousands of Canadians, including contract and self-employed workers, who were not eligible for EI.

The government immediately recognized the urgency of providing financial support to millions of vulnerable Canadian families and created a new benefit, the Canada Emergency Response Benefit (CERB). The CERB has provided payments of $2,000 per month to millions of individuals.

The program was originally designed to provide 16 weeks of support but as economies slowly and safely restart, many Canadians still face challenges. To ensure Canadians continue to have the help they need as they transition back to work, the government has extended the CERB for up to a total of 24 weeks. As announced by the Prime Minister on June 16, the government will monitor international best practices, the economy, and the progression of the virus and, if needed, make necessary changes to the program later this summer so people can have the help they need while supporting the recovery.

Figure 1.1

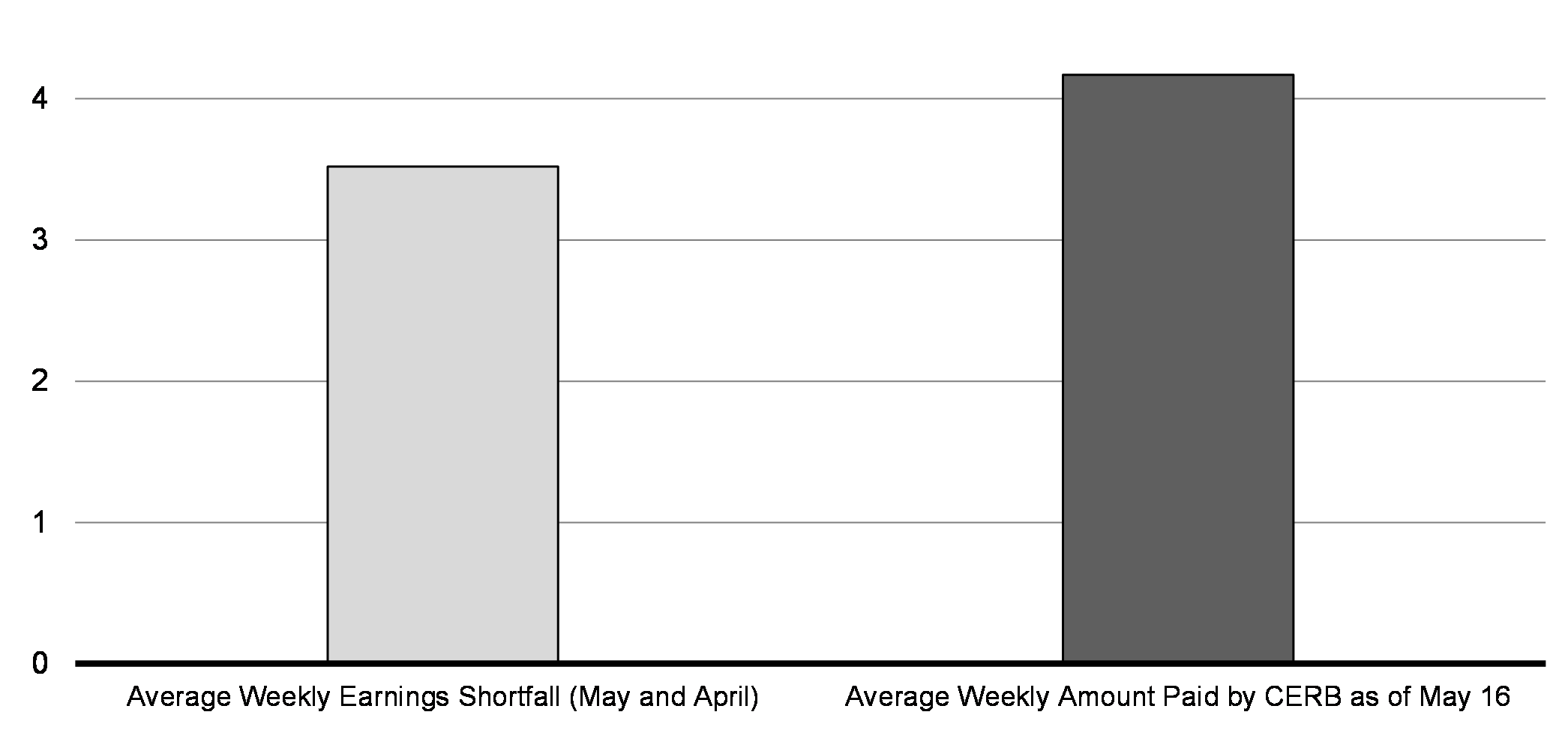

In aggregate terms, CERB payments made from mid-March to May have largely replaced all the employment income lost by Canadians during the pandemic (Chart 1.2). For lower-income and vulnerable Canadians, who were especially hard-hit by the crisis, this support has been critical in helping them afford essentials like rent, groceries and medicine.

Chart 1.2

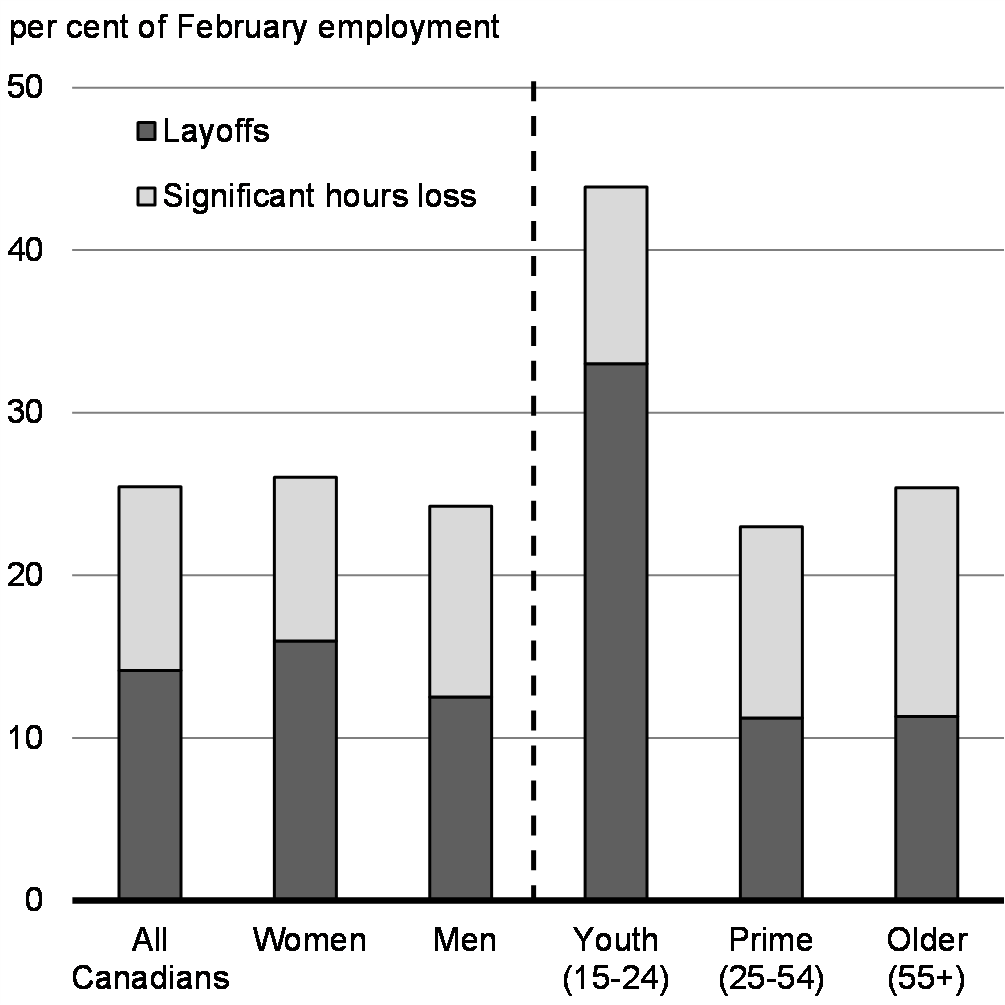

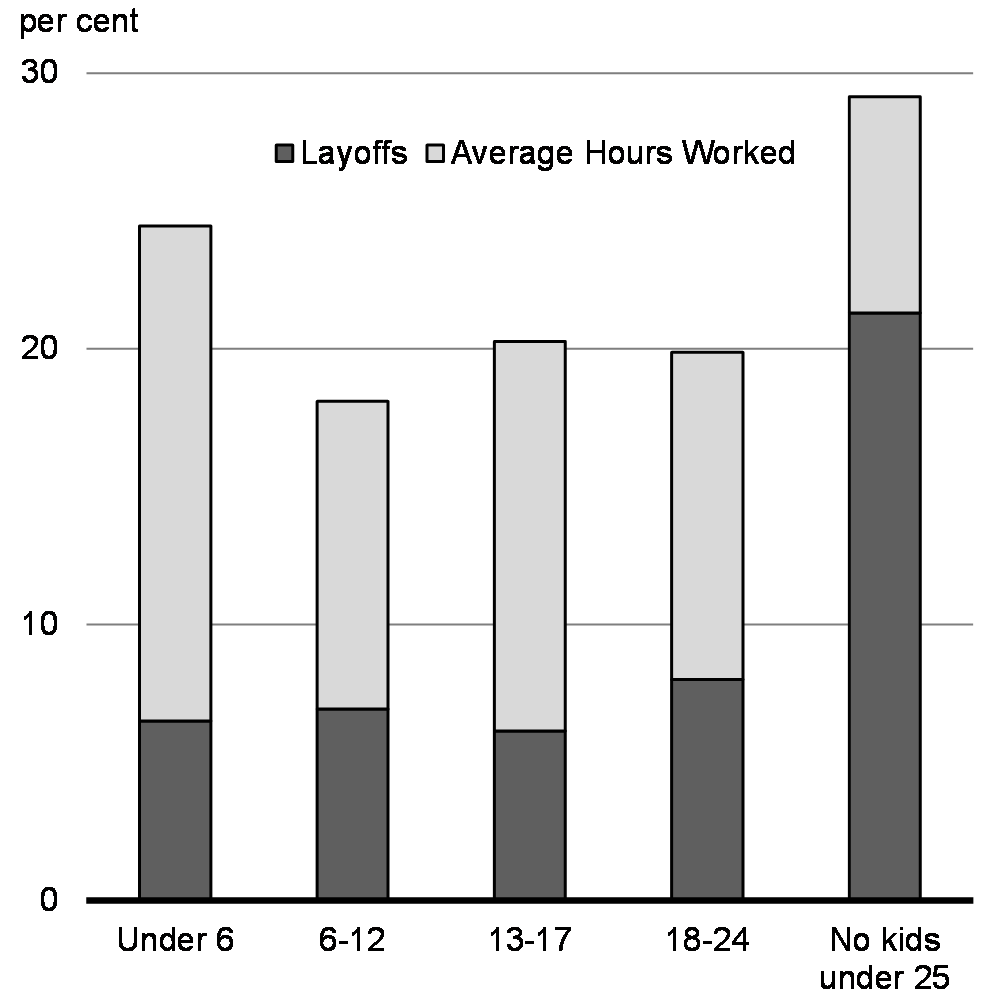

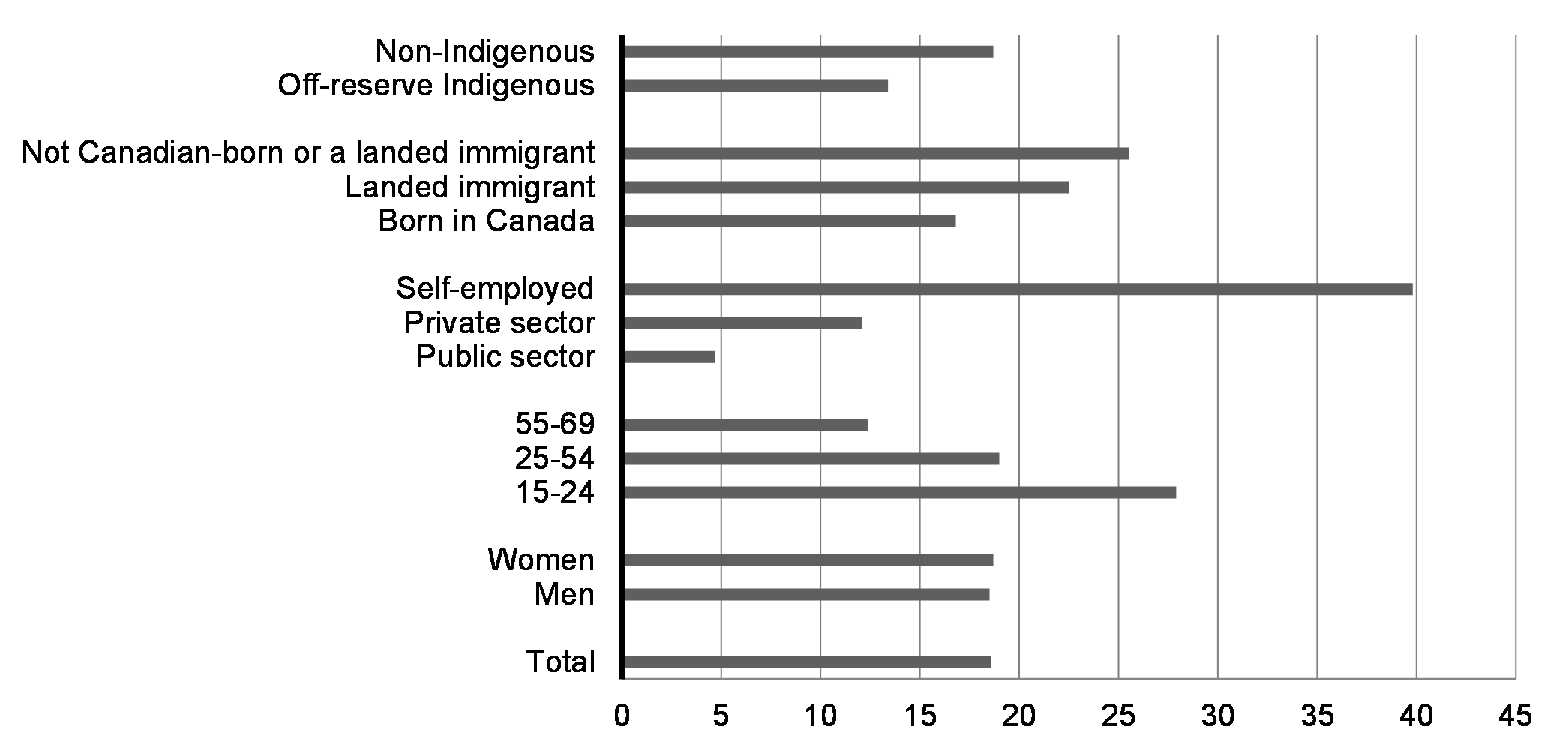

Not all groups have been equally affected by the economic crisis (Chart 1.3). Women have experienced more layoffs and a larger reduction in hours worked, with fewer able to get back to work as the economy began to recover in May. Low-wage workers, youth and very recent immigrants bore the brunt of employment losses in March and April. Moreover, working parents have also been hard hit by the downturn, with the working hours of mothers of young kids falling proportionally more than other mothers, reinforcing the important role of child care in helping Canadians return to work when jobs become available.

Chart 1.3

For some groups, including youth and very recent immigrants, employment has shown very little recovery in May. These results reflect the staggered approach to re-opening the economy and employment patterns across groups. Certain sectors like manufacturing and construction work, which account for a greater proportion of men employed, have seen employment rebounding, while other sectors like accommodation and food services, which employs a large number of women and immigrants, are still slowed down because of public health measures and low levels of demand. Addressing these very real gaps in employment as they evolve remains a priority for the government. Although our data does not yet fully capture the unique experiences of racialized Canadians, we recognize that racialized people, including Black Canadians, are more likely to work frontline jobs, have lower incomes, have health disparities, and experience systemic discrimination, which compound economic hardships related to the pandemic.

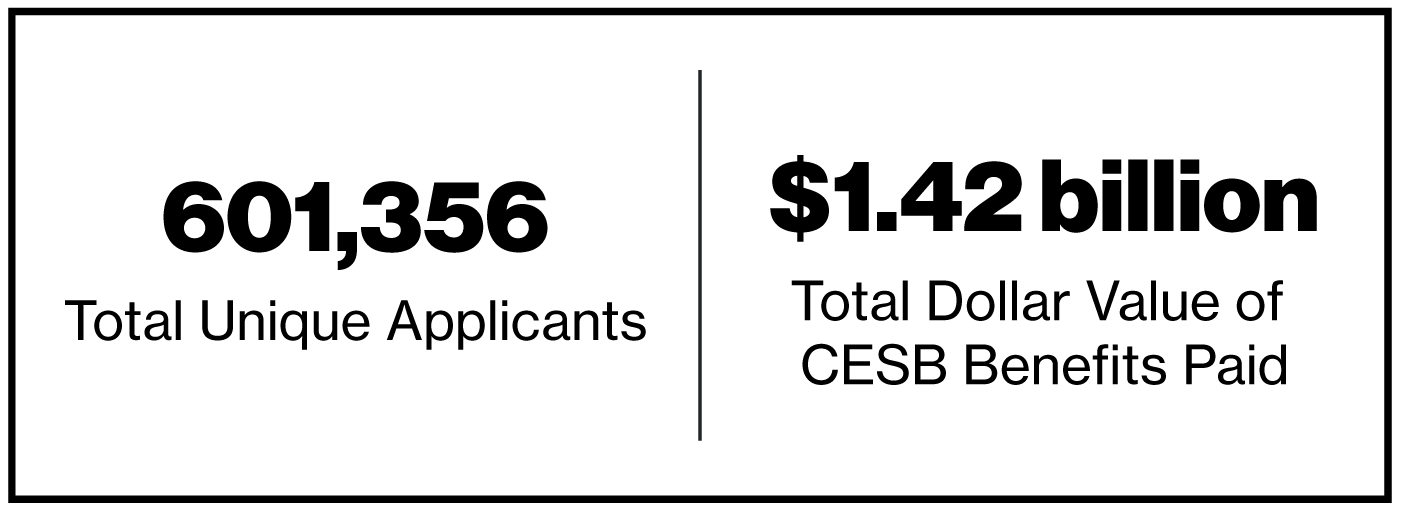

Canada Emergency Student Benefit (CESB)

Post-secondary students and recent graduates are also feeling the impacts of the pandemic. They are at a critical stage of life, needing income at the end of the school year to help with living expenses or save for next semester’s tuition, but are facing a challenge finding work due to COVID-19. Additionally, women are already facing increased unemployment during COVID-19 and may make up more of the student population that is ineligible for CERB, as around 60 per cent of all post-secondary students in Canada are women. Further, students are highly likely to be below the age of 29, and are less likely to have the financial security to weather a period of unemployment.

To support students and new grads who do not qualify for the CERB or EI, and who are unable to find employment or unable to work because of COVID-19, the government created the Canada Emergency Student Benefit (CESB). The CESB, available for four months (from May to August 2020), was designed to address the unique labour market challenges of students and support them as they work towards their goals.

Figure 1.2

Additionally, 165,008 applications have been received for the enhanced benefit amount, which provides an additional $750 per month on top of the $1,250 base benefit amount to eligible students with dependants or a disability.

According to a crowdsourcing survey conducted by Statistics Canada from April 19 to May 1, 2020, prior to the announcement of the CESB, 73 per cent of continuing post-secondary students were very or extremely concerned about using up their savings and 61 per cent were very or extremely concerned about increased student debt. After the announcement, these shares declined to 61 per cent and 47 per cent, respectively.

Low Income Student (Post-Secondary)

Anna is a 20-year-old student who recently completed her second year of full-time studies.

Last year, Anna worked full-time during the summer, earning minimum wage ($2,400 per month), in order to cover her living expenses while living away from home and to save for the upcoming school year. Due to the economic impacts of the COVID-19 health emergency, Anna did not find a full-time job this summer, leaving her unable to pay for immediate expenses such as rent and food, while also putting in jeopardy her ability to continue her studies in the fall. Anna is not eligible for Employment Insurance (EI) or for the Canada Emergency Response Benefit (CERB), since she was not employed when the health emergency began.

- To provide much needed support over the summer, Anna will receive the Canada Emergency Student Benefit (CESB), which will provide her with $1,250 per month from May through August 2020.

- While receiving the CESB and continuing to look for work, Anna decided to volunteer in a service position with a local community organization to support the broader COVID-19 response. Anna’s contribution will be recognized through the Canada Student Service Grant, which will provide up to $5,000 towards her post-secondary education costs in the fall.

- To further ensure that Anna is financially able to return to campus in September, changes to the Canada Student Loans Program will mean Anna will receive up to $6,000 in non-repayable financial assistance, support that Anna can use to cover tuition, books and living expenses.

- In April, Anna received a special GST Credit top-up payment of $290 to help her cover immediate expenses.

- Anna will receive $1,250 for each month she is unable to find work, from May to August 2020, for a maximum of $5,290 in income support. She is also eligible for up to $11,000 in non-repayable grants to cover her post-secondary education costs in the fall.

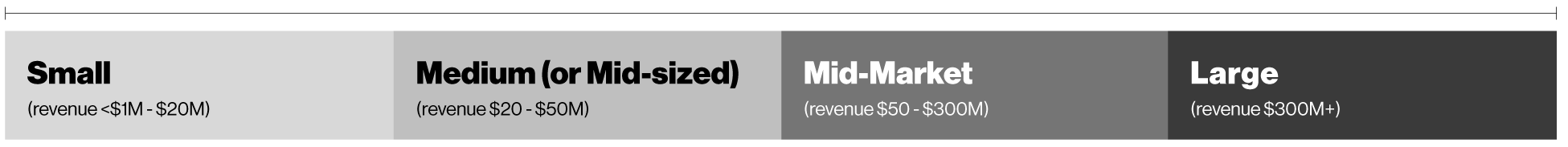

Building a Bridge for Businesses

The Plan has been focused on creating bridge financing for businesses of all sizes, and helping them deal with their fixed costs during this crisis, so they can remain solvent and keep Canadians employed. Supports for businesses have been tailored by firm size and relative access to other sources of financing. They are designed to provide a continuum of financing support across the economy to make sure that, no matter where Canadians work, the government is providing support.

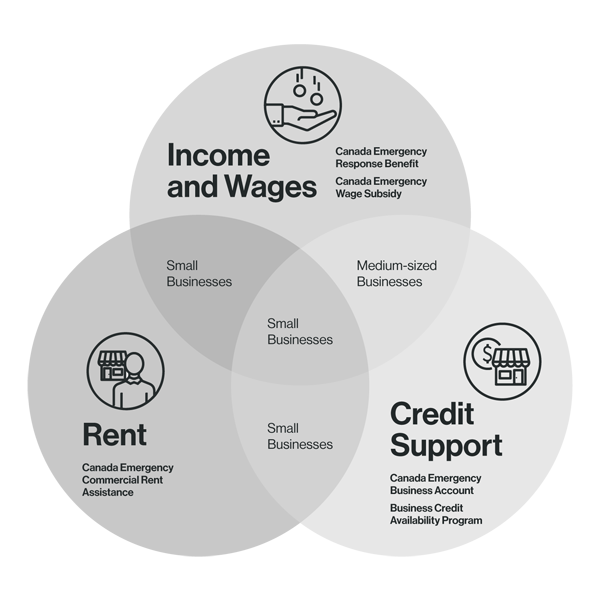

Figure 1.3

The goal of the Plan is to help businesses access the credit they need to weather the current crisis and so they can be there for their employees and Canadians when this passes. Business financing supports are intended to be comprehensive, fair and temporary. They have been timely and sequenced, with the required speed and flexibility at the small business level. For larger firms, a more commercial approach was developed to meet their financing needs, as these firms tend to have more potential sources of financing.

Support for Small and Medium-sized Enterprises

Revenues- Income Tax, Sales Tax and Customs Duty Payment Deferrals

- Business Credit Availability Program

- Canada Emergency Business Account

- Small to Medium-sized Enterprise Loan and Guarantee Program

From the start, the government was focused on providing support to small businesses in the fastest way possible. 98 per cent of all employers in Canada are small businesses. They provide good local jobs and are often at the heart of their communities. These businesses often have comparatively more limited access to capital and financing than larger firms. Small businesses also often have a limited capacity to service additional debt and need targeted support to manage fixed costs. The Plan provides targeted support to small businesses, helping them bridge through this challenging economic period.

Figure 1.4

Measures for small businesses have been designed to provide timely support for those struggling to manage fixed costs, such as salaries and rent. Under the Plan, small businesses affected by COVID-19 are able to benefit from the Canada Emergency Commercial Rent Assistance (CECRA), which, in partnership with the provinces and territories, provides forgivable loans to qualifying commercial property owners to reduce the rent owed by eligible small businesses by 75 per cent. This, in addition to the CEWS, will offer significant relief to small businesses struggling to manage their monthly fixed costs.

As of July 3, CMHC, the CECRA program administrator, has approved applications representing over 29,000 small businesses with over 209,000 employees, and total requested funding of over $221 million. In addition to thousands of applications from property owners in progress or being processed, CMHC is working closely with large property owners to complete applications to provide rent support to a further 25,000 small businesses. CECRA funding to date has been provided to a broad cross-section of Canadian small businesses in all provinces and territories, including restaurants, retail stores, medical and dental clinics, hair and nail salons, gyms and dance studios, and many more. To provide further support as hard hit businesses begin to re-open, the Government has since announced that CECRA will be extended a further month, covering July rent.

Local, Family-owned Restaurant

Sammy owns a family-run restaurant that his parents opened when they immigrated to Canada.

- In March, to comply with emergency measures, Sammy was forced to temporarily close the restaurant, and layoff the restaurant’s employees with no pay. Sammy’s restaurant never offered take-out or delivery, but, on April 19, Sammy decided to offer these services to the community, and was able to hire back four of his staff, each with a salary of $750 per week. Despite his efforts, Sammy experienced an average revenue decline of more than 70 per cent from April to June compared to the corresponding periods in 2019.

- Sammy was very concerned about how to pay his $5,000 in rent. In late March, Sammy approached his property owner, Mary, about the possibility of reducing his monthly rent. While Mary was very sympathetic, and concerned about her ability to preserve her future rental revenue should Sammy lose his business, she was only able to defer a portion of Sammy’s rent given her own expenses to maintain the commercial property.

- Sammy and Mary were able to access the CECRA. Mary obtained a forgivable loan from CMHC in the amount of $7,500, equal to 50 per cent of Sammy’s gross monthly rent for April, May and June, and is considering applying for the one-month extension to provide Sammy with a bridge to relaunch his business as the economy re-opens. Sammy and Mary equitably shared the remaining 50 per cent of Sammy’s monthly rent, reducing Sammy’s rental obligations to a more manageable $1,250 per month for the corresponding period.

- Sammy was able to access the CEWS which provides a subsidy of 75 per cent of an employee’s salary to help him pay for his labour costs. For the months of April to early June, he received a total of $15,750 in CEWS support to pay his four employees.

- Sammy was also able to access the Canada Emergency Business Account, an interest-free, partially forgivable loan of up to $40,000 to help pay non-deferrable operating expenses for his business, including the rent and payroll expenses remaining after receiving CECRA and CEWS. Through his financial institution, Sammy could also apply for the SME Loan and Guarantee Program under the Business Credit Available Program should he need additional financing.

- In addition, Sammy has the flexibility to defer any payment of income tax amounts that become owing until after August 31, 2020, and was able to defer remittance of collected GST/HST and customs duties until June 30.

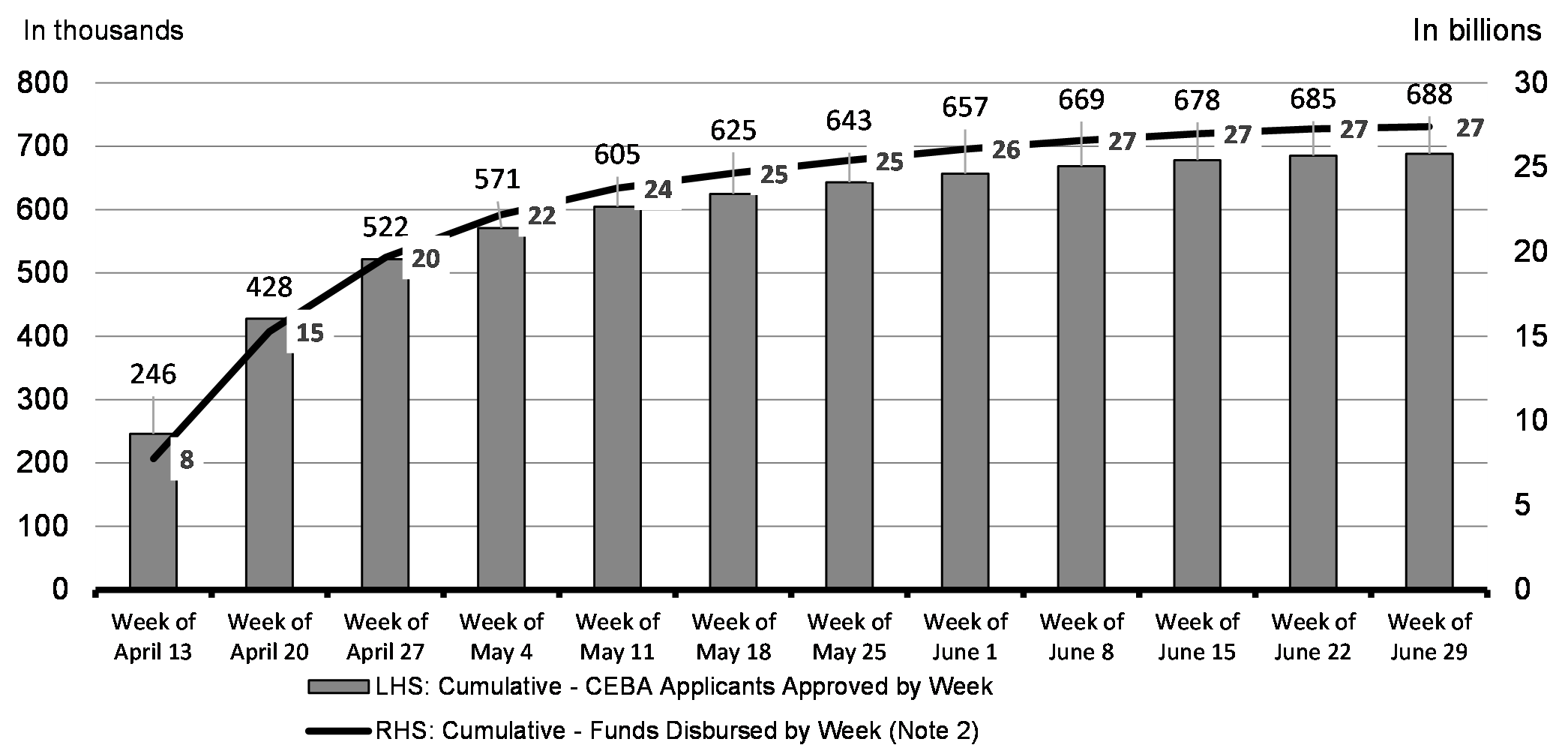

Small businesses also have access to the Canada Emergency Business Account (CEBA), which is part of the Plan’s Business Credit Availability Program (BCAP). The CEBA provides interest-free, partially forgivable loans of up to $40,000 and is offered through financial institutions, such as banks and credit unions, in cooperation with Export Development Canada. This approach uses existing relationships between businesses and their financial institutions and enables support to be provided broadly and rapidly. As of July 3, 688,000 applicants have been approved for CEBA for a total of $27.41 billion in cumulative funds disbursed, including $7 billion which is forgivable if the loan is paid back before December 31, 2022 (Chart 1.4). Over 65 per cent of the businesses eligible based on the payroll criteria have benefited from the program based on the initial set of eligibility criteria through early June.

Through the BCAP, small to medium-sized businesses can also access a wider range of credit and liquidity support, up to $12.5 million through the Small and Medium Enterprise co-lending program and a further loan of up to $6.25 million under the BCAP Guarantee program. As of July 3, 148 guarantees have been confirmed for a total loan value of over $303.59 million. Based on the experience with similar products made available during the 2008-2009 financial crisis, uptake of these programs is expected to grow steadily over time.

Chart 1.4

A Small Manufacturing Company

Ali owns a small manufacturing corporation in Markham, Ontario that fabricates auto parts. 75 per cent of its output is exported. The company employs 25 full time employees, each earning an average monthly salary of $4,250. They have had a few large orders suspended, resulting in a 35 per cent revenue drop.

The company was able to access the CEWS for wage subsidies of $79,688/month, for a total benefit of $239,063 for the period of March 15 to June 6, 2020 to maintain its workforce of 25 employees. It can defer any payment of income tax amounts that become owing until after August 31, 2020, giving the business more financial flexibility to address immediate needs. The company was also able to defer payments of GST/HST, as well as customs duty payments on imports, until June 30.

Ali was also able to access the Canada Emergency Business Account, an interest-free, partially forgivable loan of up to $40,000 to help pay non-deferrable operating expenses for his business, including the rent and payroll expenses.

Ali can also speak to his bank about existing business credit products and specific opportunities for relief. If his needs exceed the level of support Ali’s bank is able to provide, the bank could utilize the BCAP SME Loan and Guarantee Program that may offer up to $18.75 million of additional credit for the company.

Support for Mid-market to Large Enterprises

Revenues- Income Tax, Sales Tax and Customs Duty Payment Deferrals

- Sector Supports (e.g., Transportation, Agriculture, Energy, Culture, Heritage and Sport, Fish and Seafood Processing)

- Financial sector liquidity and market functioning facilities

- Business Credit Availability Program (BCAP)

- Mid-market Guarantee and Financing Program (BCAP)

- Large Employer Emergency Financing Facility

- Enhancements to the Work-Sharing Program

Millions of Canadians are employed by mid-market and large businesses. The government recognizes that firms of all sizes need access to support to weather the COVID-19 pandemic and to recover. Access to financing has become more challenging for companies of all sizes, including larger companies, because the duration of the economic disruption caused by COVID-19 is uncertain and future demand for goods and services is difficult to predict. Companies that would be financially viable after the crisis may not be able to maintain operations until then without additional credit support.

The BCAP is providing support tailored for mid-market businesses across the economy with larger financing needs. These companies tend to have annual revenues of between $50 million and $300 million. Support for these businesses will include loans of up to $60 million per company and guarantees of up to $80 million.

Larger companies are regionally or nationally important and key suppliers of goods and services in supply chains. Access to financing supports ensures larger companies can pay the salaries of millions of Canadians these businesses employ, and support the suppliers who rely on their business.

The Plan offers support for Canada’s largest employers to help protect the jobs of millions of Canadians. The Large Employer Emergency Financing Facility (LEEFF) offers bridge financing to Canada’s largest employers, whose needs during the pandemic are not being met through conventional financing. To qualify for LEEFF, eligible enterprises must be seeking financing of $60 million or more; have significant operations or workforce in Canada; and not be involved in active insolvency proceedings. Companies that have been convicted of tax evasion are not eligible to apply to LEEFF. Companies that receive LEEFF funding are required to publish an annual climate-related financial disclosure report, consistent with the Financial Stability Board’s Task Force on Climate-related Disclosures, and provide information on how they are contributing to achieving Canada’s commitments under the Paris Agreement and goal of net-zero by 2050. Companies are also required to meet obligations under existing pension plans and collective bargaining agreements.

Market Liquidity and Credit Support

From the outset, the government moved quickly to support market liquidity to help ensure that businesses could continue to access credit and promote well-functioning provincial funding markets. In cooperation with the Bank of Canada, the Office of the Superintendent of Financial Institutions (OSFI), the Canada Mortgage and Housing Corporation (CMHC) and commercial lenders, the government made over $600 billion in liquidity support accessible.

For example, the Bank implemented facilities to support key financial markets and financial institution liquidity so that they could continue to serve businesses and households and support liquid and well-functioning provincial funding markets. OSFI lowered the Domestic Stability Buffer to increase the lending capacity of Canada’s large banks and support the supply of up to $300 billion in additional lending into the economy. The government also announced that CMHC would purchase up to $150 billion in insured mortgage pools to provide long-term stable funding to banks and mortgage lenders, help facilitate continued lending to Canadian consumers and businesses, and add liquidity to Canada’s mortgage market.

Regional Support

This economic crisis has affected all regions of Canada, but each in its own way. For some regions, the impact has been severe.

The government’s Regional Relief and Recovery Fund is providing $962 million, through Canada’s six Regional Development Agencies, to support affected businesses that are key to regional and local economies, including in rural communities. These businesses provide good local jobs and support the families and communities they serve. These could be manufacturing, technology, or tourism companies, for example, that need help recovering from the pandemic but don’t qualify for other supports.

Fish harvesters have faced pressures as lockdown measures have combined with lowered demand. The government is making available $469.4 million in grants and income support to support the workers that help feed Canadians families.

In energy-producing regions of the country, Canadians are facing the compounded challenge of the COVID-19 economic crisis and the shock to oil prices. The government is providing $1.72 billion to the governments of Alberta, Saskatchewan, and British Columbia and to the Alberta Orphan Well Association, to clean up orphan and inactive oil and gas wells. This will help keep Canada’s environment clean and maintain approximately 5,300 jobs in Alberta alone. In addition, the $750 million Emissions Reduction Fund will provide conventional and offshore oil and gas companies with repayable contributions to support their investments to reduce greenhouse gas emissions and conduct research and development. This will be particularly helpful to the offshore oil and gas sector, which is primarily located in Newfoundland and Labrador, and which will receive up to $75 million of this support.

Looking forward to the months, years, and decades to come, Canada’s economy must become more resilient. Canada must continue to diversify and build an economy that is stable, healthy, and equitable, in every region of the country.

Working Together with Provinces and Territories

From the beginning, this has been a Team Canada effort. Federal, provincial, territorial, and municipal governments have come together to protect Canadians, fight this disease, and stabilize Canada’s economy.

At the federal level there have been a myriad of supports to help provincial and territorial governments through this economic crisis. The Bank of Canada introduced the Provincial Money Market Purchase Program, to support the liquidity and efficiency of provincial funding markets. To supplement this program, the Bank also created the Provincial Bond Purchase Program, helping maintain well-functioning provincial funding markets as governments seek significant funding for their emergency measures to support businesses and households. Combined, these measures have provided $12.4 billion in support.

Furthermore, the federal government’s income support measures for Canadians —which have effectively replaced all lost labour income in aggregate terms— are also providing significant support to provinces and territories by helping to protect their income tax and sales tax revenue bases. Income tax represents around 35 per cent of provinces’ own-source revenues, and sales tax, for jurisdictions that have it, represents about 20 per cent—both of which have been partially buttressed by federal supports.

As the Canadian economy begins to safely restart, the government will continue to consult with public health officials and work closely with provincial and territorial governments to protect the health of Canadians during this uncertain time. Safely restarting economic activity will require a gradual and phased approach, guided primarily by health and safety considerations, and requiring continued close collaboration and coordination across all levels of government.

On April 28, the federal and provincial and territorial governments announced a set of common principles for restarting the Canadian economy. These principles will shape how Canada will move forward over the weeks and months ahead. The government will continue to monitor the state of the economy and take action as necessary to protect Canadians and the economy.

“Our priority is keeping all Canadians safe, while getting back to normal as much as we can. That’s why First Ministers have worked on a set of shared principles to gradually restart the economy, based on science and evidence-based decision-making. Together, we will continue to work collaboratively to keep Canadians safe and healthy, and protect our economy.”

The Rt. Hon. Justin Trudeau, Prime Minister of CanadaRestarting the Canadian economy is a complex process. The government is committed to working with provinces and territories to ensure the appropriate supports are in place for all Canadians. As announced by the Prime Minister on June 5, the government will invest approximately $14 billion to support provinces and territories in the safe reopening of the country’s economies over the next six to eight months.

A World-class Response

Countries around the world have taken swift and significant actions to address the economic consequences of the COVID-19 pandemic. According to the International Monetary Fund, policy support announced by G20 countries since the beginning of March, on average, already exceeds the fiscal stimulus provided in the three years that followed the 2008-2009 global financial crisis.

Economic response plans across countries have generally focused on supporting health care systems, protecting the incomes of workers and their families, and easing cash-flow constraints on businesses through tax and fee deferrals and measures to boost credit and liquidity. Additional monetary and financial stability actions have also been taken.

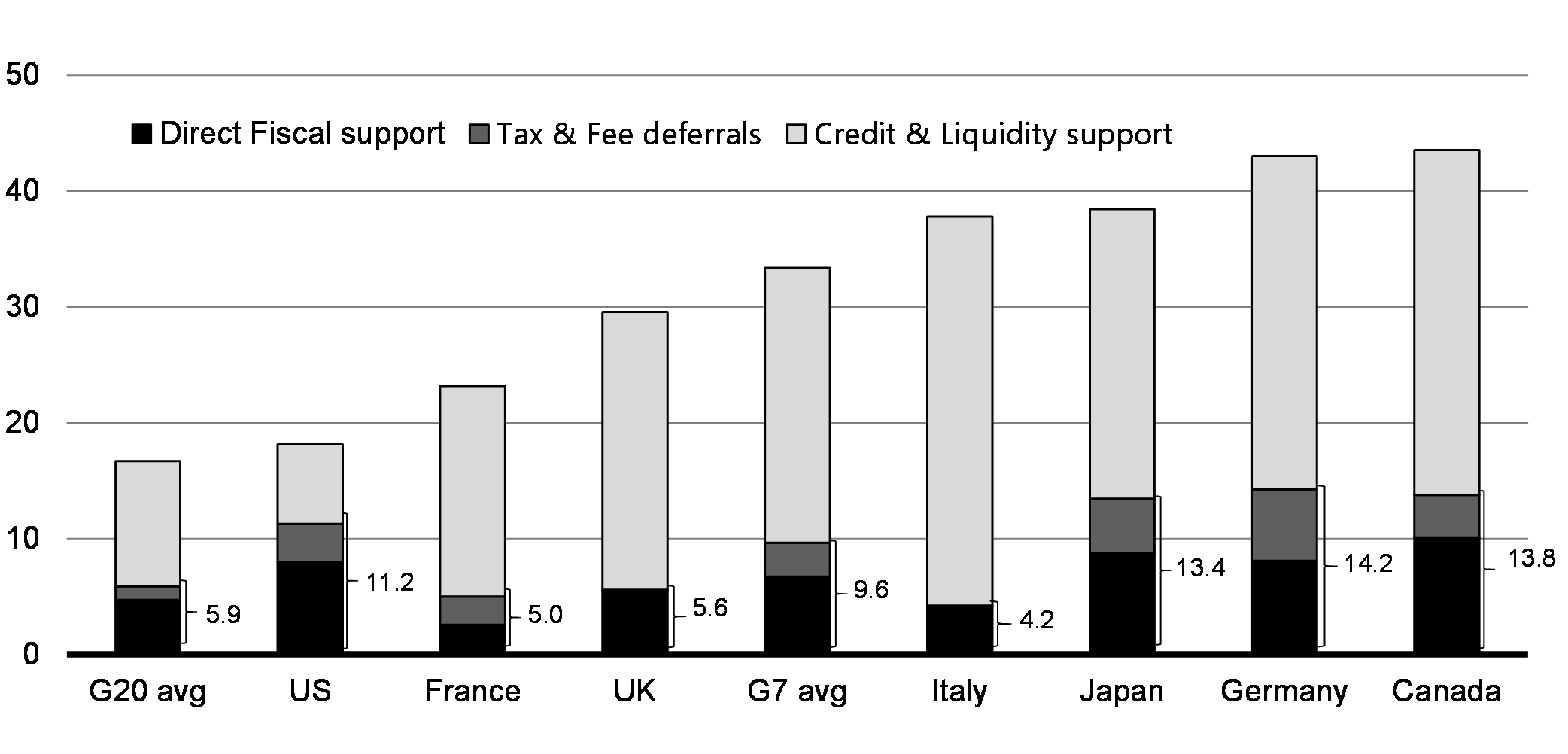

Chart 1.5

Canada’s strong fiscal position going into the pandemic has allowed the government to implement an ambitious economic response plan by international standards. Direct fiscal support measures alone represented over 10 per cent of Canada’s GDP, relative to 6.7 per cent on average for G7 countries, with the bulk of support directed at individuals and households. In comparison, the U.S. plan also devotes a large share of direct support to individuals and households but to a lesser extent than Canada.

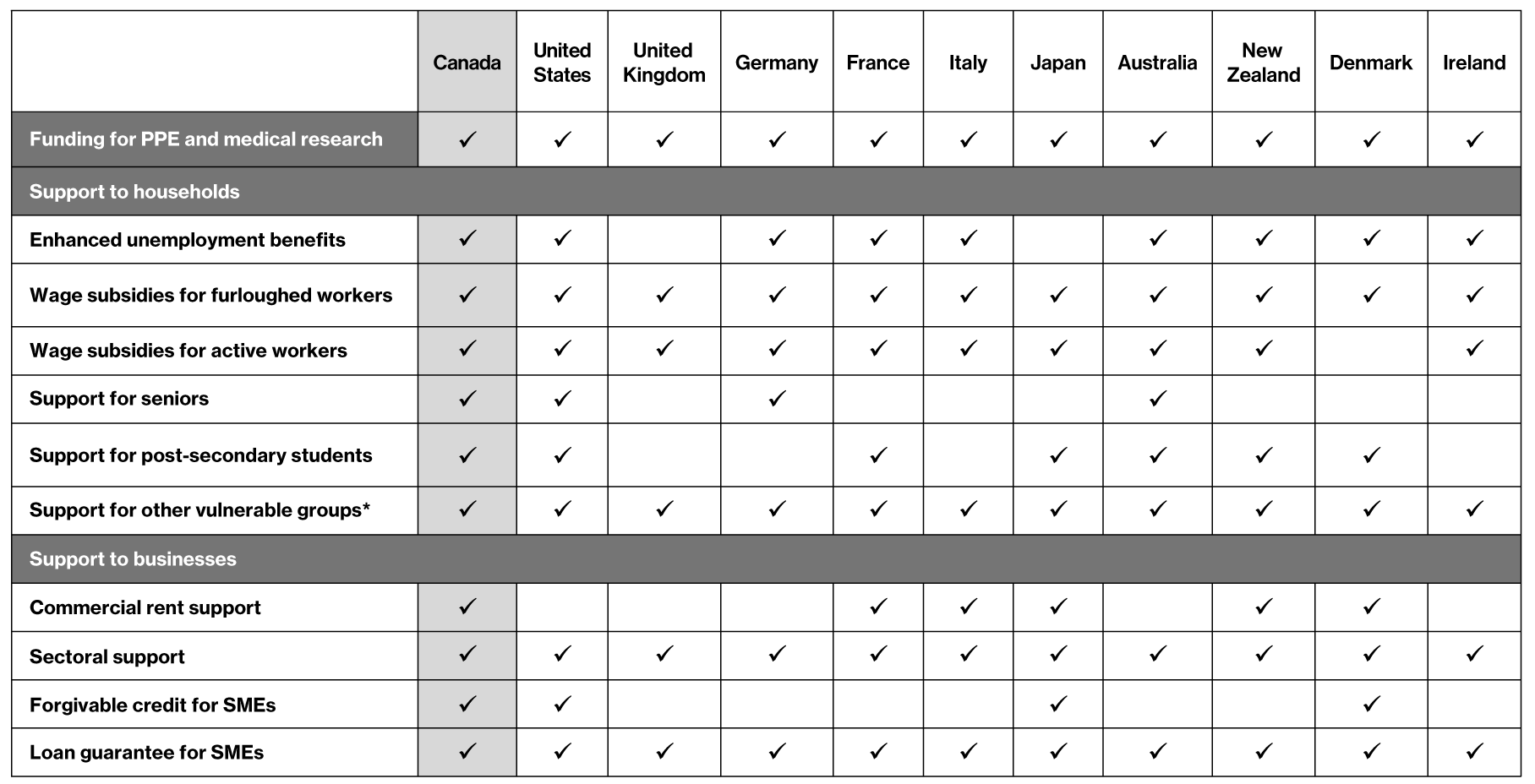

Beyond its total size, which is among the most significant in the G7 and the G20, Canada’s plan is also among the most comprehensive, covering a broader range of measures than most plans announced in peer countries. Canada is notably one of the few countries that has announced both a national program to provide commercial rent assistance for small businesses and forgivable credit to SMEs. The range of support to households through Canada’s support measures also compares favorably through this crisis. For example, the Canada Emergency Wage Subsidy aims to help Canadian employers keep their employees (both active and furloughed) on the payroll. This is in addition to enhanced unemployment benefits provided to Canadians and a broad range of targeted supports for students, seniors and other vulnerable groups.

Figure 1.5

An International Effort

The government recognizes the importance of working with its international partners to address the health and economic impacts of the COVID-19 pandemic.

Canada has been working closely with its partners in the G7, the G20, international financial institutions such as the International Monetary Fund and the World Bank, the World Trade Organization and other international organizations, to support global economic stability. This collective work has been aimed at coordinating research efforts; sharing data and intelligence on strategies to delay the spread of the virus; addressing disruptions to international supply chains; and designing and implementing financial assistance to help those in most vulnerable countries.

In particular, together with its G7 and G20 partners, Canada designed and endorsed the G20 Action Plan – Supporting the Global Economy Through the COVID-19 Pandemic. Through this plan, G20 and Paris Club members will suspend bilateral debt services payments on official debt for the poorest countries.

Canada continues to collaborate closely with its international partners to implement these commitments. Canada has also joined trading partners at the World Trade Organization, and in other forums, in calling for open and predictable global trade to maintain the flow of essential goods such as medical supplies and food.

On May 4, Canada joined other global leaders to launch the Coronavirus Global Response to help researchers and innovators develop solutions to test, treat, protect people and prevent the further spread of COVID-19. During this pledging event, the Government of Canada highlighted investments of over $850 million to support the US$8 billion fundraising target of this initiative. Canada’s support includes funding for vaccine development, mobilizing Canadian researchers’ and life sciences companies’ research and development of medical countermeasures, and contributing diagnostic support to more than 20 partner countries.

In addition, on May 12, the Minister of International Development announced $600 million to Gavi, the Vaccine Alliance to contribute to ensuring regular routine immunizations for hundreds of millions of children around the world and reduce the burden of infectious diseases.

On May 28, the Prime Minister co-convened the High-Level Event on Financing for Development in the Era of COVID-19 and Beyond, with the UN Secretary-General and Prime Minister of Jamaica, to look at areas of action to mobilize the financing needed for COVID-19 response and recovery.

On June 27, the Government committed $120 million in support of the activities of the Access to COVID-19 Tools Accelerator – with $20 million of that total for the Coalition for Epidemic Preparedness Innovations. Canada will also invest an additional $180 million to address the immediate humanitarian and development impacts of this crisis, helping communities in developing countries mitigate and address the challenges they are facing right now.

Next Steps

As economies continue to safely reopen and lockdown measures are lifted, everyone must strictly follow virus containment measures to prevent further outbreaks. Nevertheless, the potential for a second wave looms and the experiences of other jurisdictions show the likely possibility of further outbreaks occurring. It is critical that the right measures are in place to ensure the health of Canadians is protected.

The government is committed to working with provinces and territories to ensure the appropriate supports are in place for all Canadians. As announced by the Prime Minister on June 5, the government will invest approximately $14 billion to support provinces and territories to:

- scale their capacity to conduct testing and contact tracing;

- build health care system capacity and strengthen infection prevention and control measures;

- address immediate needs and gaps in the support and protection of people experiencing mental health and problematic substance use challenges;

- address immediate needs and gaps in supportive care (including long-term care and home care) and provide health and social supports for other vulnerable groups;

- ensure health care and essential workers have access to personal protective equipment;

- ensure a safe and adapted supply of child care for returning workers as the economy re-opens;

- ensure Canadians have up to 10 days of paid sick leave should they contract or show symptoms of COVID-19; and,

- provide municipalities with the support they need to address the increased costs associated with COVID-19.

These investments will ensure that provinces and territories not only have the assistance they need to support the reopening of their economies and help people return to their day to day lives, but it also ensures they are prepared for the possibility of a future resurgence of the virus.

Beyond this, the government will continue to take actions to improve both the economy and Canadians’ quality of life. The COVID-19 crisis has significantly affected all aspects of Canadians’ lives—from their health to their livelihoods. It is also clear that this crisis has disproportionately affected vulnerable communities and underscored systemic barriers faced by Indigenous and racialized communities in Canada. It is now critically important that Canada pursue inclusive growth and continue to support Canada’s most vulnerable.

Traditional economic measurements such as Gross Domestic Product (GDP) alone do not give a full picture of Canadians’ quality of life, and the pandemic has further exposed this fact. The government is working on incorporating quality of life measurements into decision-making, including in the development and implementation of Canada’s COVID-19 Economic Response Plan.

The Plan has prioritized these factors working as quickly as possible to help as many Canadians as possible - from seniors to students, to families with children and low-income frontline workers, to Indigenous communities. The government will continue to take action to protect vulnerable citizens so they do not fall through the cracks, while supporting a strong economy, promoting sustainability, and reducing inequality and poverty.

This is an opportunity for Canada to build back better through investments in a strong, inclusive and green recovery, which supports new opportunities for workers in every region of this country. Looking to the future, the government must not only think of the months ahead, but the years and decades to come. The government is committed to ensuring that no Canadian is left behind as it works to create a more sustainable and resilient economy in the wake of the pandemic, and for the generations to come.

GBA+ Summary of Canada’s COVID-19 Economic

Response PlanGBA+ Impacts of COVID-19

While COVID-19 and related public health measures have affected all Canadians in one way or another, the type, severity and extent of the impacts of COVID-19 vary considerably across social and demographic characteristics. Leveraging the themes of the Gender Results Framework, this section briefly discusses the impacts of COVID-19 on diverse groups of Canadians. The Plan was designed to respond to these impacts, and relevant measures are highlighted after each pillar.

Although this analysis sheds some light on the impacts of COVID-19 across varying social, demographic, and economic categories, the government recognizes that this analysis is limited by the availability of data, especially for certain identity factors such as race, sexual orientation and disability. It is clear that there is more work to do to ensure that disaggregated data are collected and to ensure that all of our policy measures are analyzed and implemented from an intersectional lens.

Note on Terminology

In this section, the term "visible minorities" is used because it is the official demographic category defined by the Employment Equity Act and used by Statistics Canada in their surveys, which facilitates longitudinal comparisons.

Education and Skills Development

Equal opportunities and diversified paths in education and skills developmentGender Results

FrameworkKey Indicators of the Impact of COVID-19

- Of over 100,000 post-secondary students participating in a crowdsourcing survey from April 19 to May 1, 92 per cent had some or all of their courses moved online, 35 per cent had a work placement cancelled or delayed, and 26 per cent had some of their courses postponed or cancelled. Among post-secondary students expecting to graduate in 2020, 17 per cent would not be able to complete their credential as planned, compared to 8 per cent for continuing students. Differences between men and women were minimal at only a couple of percentage points.

Note on Methodology

Although crowdsourcing surveys are key in obtaining timely information about important issues, such as the extent to which COVID-19 is affecting the lives and well-being of different groups of Canadians, readers should note that unlike other surveys conducted by Statistics Canada, the lack of probability-based sampling means that the findings are not representative and cannot be applied to the overall Canadian population. In particular, some groups of Canadians may be over-represented, while other groups may be under-represented.

Government Response To Date

- Canada Emergency Student Benefit for students who are not receiving the Canada Emergency Response Benefit and are unable to find work due to COVID-19.

- Canada Student Service Grant of up to $5,000 towards students’ fall education.

- Changes to the Canada Student Loans Program and Canada Summer Jobs.

- Supporting student researchers and post-doctoral fellows through extensions to research scholarships and fellowships and supplements to research grants.

- Removing work restrictions for international students under certain conditions.

- $75.2 million in distinctions-based support to Indigenous post-secondary students.

- 149,500 jobs, placements, and other training opportunities to help students find employment.

- Covering up to 75 per cent of costs for eligible wages and research activities at university and health research institutes.

Economic Participation and Prosperity

Equal and full participation in the economyGender Results

FrameworkKey Indicators of the Impact of COVID-19

- Between February and April, 5.5 million Canadians were affected by COVID-19 by either job loss or reduced hours. In May, employment rose by 290,000, while the number of people who worked less than half their usual hours dropped by 292,000.

- In April, the labour underutilization rate – which includes the unemployed; those who were not in the labour force who wanted a job but did not look for one; and those who were employed but worked less than half of their usual hours – was 37 per cent, up from 12 per cent in February. In May, it declined slightly to 35 per cent. Although both men and women had a labour underutilization rate of 12 per cent in February, by April, men’s labour underutilization rate was 35 per cent, compared to 39 per cent for women, with each dropping by 2 percentage points in May.

- Employment losses between February and May were largest in accommodation and food services (44 per cent) and information, culture and recreation (22 per cent). Other industries with notable losses include wholesale and retail trade (15 per cent), manufacturing (10 per cent) and construction (10 per cent). Agriculture saw employment gains of 6 per cent.

- Reflecting industrial segregation between women and men, women accounted for a disproportionate share of job losses in March, while in April, declines were larger among men. Cumulative employment losses from February to April were thus evenly split between women (17 per cent) and men (15 per cent). However, in May, employment increased more than twice as fast among men than among women, reducing total cumulative employment losses to 13 per cent for men and 16 per cent for women. This is consistent with the more rapid increase in goods-producing industries, which account for a greater proportion of men’s employment than women’s employment.

- Labour market impacts in March and April were more strongly felt among low-wage workers and youth, who were particularly hard hit by job losses. In May, low-wage workers saw some encouraging rebounds in employment. Although employment among youth increased by 2 per cent in May, this only slightly reduced the cumulative employment losses.

- Employment among very recent immigrants (five years or less) fell more sharply from February to April than it did for those born in Canada. In addition, there was no rebound in employment in May for very recent immigrants, while employment among those born in Canada rose by 5 per cent. Among recent immigrants, the decline was larger among women than men.

- Urban and off-reserve Indigenouspeoples and non-Indigenous Canadians have experienced similar cumulative job losses through COVID-19 (11 per cent and 12 per cent, respectively).

- In a crowdsourcing survey in late-May and early-June, 47 per cent of persons identifying as WestAsian, 42 per cent of persons identifying as Filipino, 40 per cent of persons identifying as Korean, and 40 per cent of persons identifying as SoutheastAsian reported experiencing a jobloss or reducedworkhours, compared to 34 per cent of persons identifying as White.

- Women are also leading the charge as frontline workers in many settings, including in hospitals and long-term care homes, although this comes with a greater risk of contracting COVID-19. For example, in 2019, women comprised 91 per cent of registered nurses, 92 per cent of nurse practitioners, and 91 per cent of licensed practical nurses.

- Immigrants are also over-represented in certain health care professions. In 2016, more than one-third of nurse aides, orderlies and patient service associates were immigrants (86 per cent of which were women) compared to one-quarter of all other occupations. They were also more likely to identify as a visibleminority (34 per cent) than workers in other occupations (21 per cent), with Black and Filipinowomen especially over-represented.

- Closures of schools and child care services during COVID-19 increased the amount of unpaid work in the home which is disproportionately carried out by women. There is evidence that this has greatly affected employed women’s job performance for those teleworking as well as unemployed women’s ability to return to work or find work, especially when child care is unavailable.

- In May, 18 per cent of core-aged women with children under 18 years worked less than half their usual hours, compared with 14 per cent of men. While both of these shares are much higher than normal, the fact that women are more likely to be absentfromwork than men is a long-standing trend reflecting women’s greater share of unpaid care work. This trend has not changed during the COVID-19 period.

- Between February and April, employmentlosses were larger among men with childrenunder6years than for women (10 per cent versus 8 per cent), while rebounds in May were larger for men than for women (5 per cent versus 2 per cent). Cumulative employment losses from February to May for women and men with children under 6 years were 6 per cent and 5 per cent, respectively. For men and women with childrenaged6-12 years, an age group that still requires significant supervision, cumulative employment losses between February and April were 4 per cent and 8 per cent, respectively.

- In 2019, Canada's telework capacity – the share of jobs that could plausibly be performed from home under normal circumstances – stood at 39 per cent. Men's telework capacity (32 per cent) was lower than women's (46 per cent). Part of this difference is explained by the fact that men and women often work in different jobs. For example, jobs in agriculture and construction – where men are over-represented – cannot be performed from home. Financially vulnerable workers, including youth, persons with a high school diploma or less, and low-income families, had the lowest telework capacities.

- In May, about 1 in 10 Canadian workers thought that they might lose their job or main source of self-employment income in the next four weeks. Low-income workers were the most likely to feel insecure, while there was little difference between women and men or across age groups.

Government Response To Date

- Canada Emergency Response Benefit for those who have stopped working due to COVID-19.

- Enhancements to the Work-Sharing Program to help employers and employees avoid layoffs.

- Supporting the safe and sufficient supply of child care for parents returning to work – as part of the approximately $14 billion to support provinces and territories in the safe reopening of the country’s economies.

- Covering 75 per cent of an employee's wages up to $847 per week for eligible employers through the Canada Emergency Wage Subsidy.

- Provided the 10% Temporary Wage Subsidy for small businesses from March to June.

- Up to $3 billion in federal support to increase the wages of essential workers.

Leadership and Democratic Participation

Gender equality in leadership roles and at all levels of decision-makingGender Results

FrameworkKey Indicators of the Impact of COVID-19

- Canadians trust their public health leaders. In a recent survey, 74 per cent of crowdsourcing participants expressed high levels of trust in provincial or territorial and federal health authorities and 65 per cent expressed high levels of trust in their municipal health authorities. Participants with a university degree were more likely to express high levels of trust in public health authorities than participants with a non-university post-secondary credential or with a high school education or less.

- COVID-19 has brought many women leaders in medicine and public health into the spotlight. Dr. Theresa Tam, Canada’s Chief Public Health Officer is a woman, as are 6 of the 13 provincial and territorial chief medical officers.

- According to a crowdsourcing survey, as of April, businesses majority-owned by women and other under-represented groups – including Indigenous persons, visible minorities, immigrants, or persons with disabilities – were more likely to report being highly affected by lower demand for their products or services, cancellation of services, uncertain accounts payable, an inability to have staff physically on-site, staff absences and reduced productivity due to remote work, reflecting that businesses majority-owned by men and women are not equally distributed across industries.

- In the same April crowdsourcing survey, among businesses that pay rent, businesses majority-owned by women, visible minorities and immigrants were more likely to report having had their rent payments deferred. Businesses majority-owned by Indigenous persons and persons with disabilities were more likely to report having requested credit from a financial institution.

Government Response To Date

- $15 million to the Women Entrepreneurship Strategy to support women entrepreneurs facing hardship due to COVID-19.

- Up to $306.8 million in funding to help small and medium-sizedIndigenous businesses and to support Aboriginal Financial Institutions.

- 75 per cent or more rent reduction for small business tenants through the Canada Emergency Commercial Rent Assistance.

- $287 million to support rural businesses and communities by providing access to capital through the Community Futures Network.

- $20.1 million for Futurpreneur Canada to continue supporting young entrepreneurs facing challenges due to COVID-19.

- Credit and liquidity support through the Canada Emergency Business Account and Business Credit Availability Programs to help cover operating costs.

- $133.0 million to help Indigenous communities support their local economies, including help for small and community-owned Indigenous businesses.

Gender-Based Violence and Access to Justice

Eliminating gender-based violence and harassment, and promoting security of the person and access to justiceGender Results

FrameworkKey Indicators of the Impact of COVID-19

- In May, 11 per cent of respondents to a crowdsourcing survey felt that the level of crime in their neighbourhood had increased since the start of the pandemic. Indigenous (17 per cent) and visible minority (14 per cent) respondents were more likely to feel crime had increased.

- Combined with job losses and financial stresses, self-isolation of victims with their abusers has created conditions that could lead to a rise in intimate partner violence and child maltreatment. For example, consultations between the Department for Women and Gender Equality and frontline organizations, provinces and territories and Members of Parliament after the start of COVID-19 found a 20 to 30 per cent increase in rates of gender-based violence and domestic violence in some regions of the country.

- In a crowdsourcing survey from late-April to early-May, 1.7 per cent of women and 1.3 per cent of men expressed that they were very or extremely concerned about violenceinthehome. Percentages for immigrantwomen (3.4 per cent), Indigenouswomen (4.3 per cent), and visibleminoritywomen (5.8 per cent) were more than twice those of non-immigrant, non-Indigenous, and non-visible minority women.

- In May, according to data from a crowdsourcing survey, men were more likely than women to report walking alone after dark and to report feeling very safe walking alone after dark in their neighbourhood since the start of the pandemic. This is consistent with reported feelings before the pandemic. Visibleminorities and Indigenous persons were more likely to report that they feel unsafe walking alone after dark than their counterparts. Prior to the pandemic, this was true for visible minorities, while there was no difference between Indigenous and non-Indigenous persons.

- 7 per cent of respondents to a crowdsourcing survey felt that harassment or attacks based on race, ethnicity, or skin colour had increased in their neighbourhood since the pandemic. Differences between men and women were minimal. Young respondents (11 per cent), non-binary respondents (22 per cent), and visible minority respondents (18 per cent), especially Chinese respondents (30 per cent), were significantly more likely to report increases in race-based incidents.

- 11 per cent of women and 8 per cent of men responding to a crowdsourcing survey reported having contacted a victims' service for a reason related to crime since the start of the pandemic. Young women were especially likely to report contact or use of a victims' service.

Government Response To Date

- $50 million to existing women’s shelters and sexual assault centres to help with their capacity to manage or prevent an outbreak in their facilities, including $10 million for Indigenous communities.

- $350 million to establish an Emergency Community Support Fund to support vulnerable Canadians through charities and non-profit organizations that deliver essential services.

- $29 million over two years to begin to build 12 new shelters in Indigenous communities and support their operational costs, and engage on how to help protect and support Métis women, girls, and LGBTQ2 people experiencing and fleeing violence.

- $157.5 million through the Reaching Home initiative to support people experiencing homelessness during the COVID-19 outbreak.

Poverty Reduction, Health and Well-Being

Reduced poverty and improved health outcomesGender Results

FrameworkKey Indicators of the Impact of COVID-19

- Women were disproportionately likely to be diagnosed with COVID-19. A similar number of women and men were admittedtothehospital. Men were more likely to be admittedtotheICU after hospitalization and women with COVID-19 were slightly more likely to die, partly reflecting the older average age of the women diagnosed.

- Seniors, as well as Canadians with underlying health conditions, are most at risk of developing severe complications that require hospitalization.

- Early evidence from certain municipalities suggests that visibleminoritiesare over-represented among COVID-19 cases. For example, Medical Officer of Health for Ottawa Public Health, Dr. Vera Etches, states that since May 8, 66 per cent of the 144 confirmed cases in Ottawa have been from racialized groups.

- In May 2020, 48 per cent of Canadians reported excellentorverygoodmentalhealth, fewer than in 2018 (68 per cent). In addition, over the course of the pandemic, Canadians’ mental health has worsened. Almost 1 in 5 Canadians reported symptoms consistent with moderate or severe anxiety – women and youth were more likely to report symptoms than their counterparts.

- In a crowdsourcing survey in late-April and early-May, 60 per cent of Indigenous participants reported that their mentalhealth was somewhat worse or much worse since the start of physical distancing, compared to 52 per cent of non-Indigenous participants. Indigenouswomen noted these impacts more than Indigenousmen. 51 per cent of visibleminorities and 52 per cent of non-visible minorities reported that their mental health was somewhat worse or much worse.

- 59 per cent of Canadians reported spending more time watching television and 69 per cent spending more time on the Internet since the start of COVID-19. In addition, 35 per cent reported eating more unhealthy foods and 26 per cent reported playing more video games. The share reporting unhealthy food consumption has increased since the start of the pandemic.

- At the same time, 37 per cent of Canadians communicated with friends and family, 12 per cent meditated, 57 per cent exercised outdoors, 40 per cent exercised indoors, and 23 per cent changed food choices.

- In 2016, about 1 in 4 Canadians would have been financially vulnerable to an economic lockdown, meaning without government transfers or borrowing, they would not have had enough liquid assets and other private sources of income to keep them out of low income during a two-month work stoppage. Lone mothers, recentimmigrants, urban and off-reserveIndigenouspeople and families where the main income earner has littleeducation were highly vulnerable financially.

- As of June 24, over 743,000 mortgage deferrals or skip a payments had been provided through 13 banks, equivalent to about 15 per cent of the number mortgages in portfolios, and more than 450,000 credit card deferral requests were in process or completed by 8 banks.

- In early May, almost 1 in 7 Canadians (15 per cent) reported that they lived in a household where there was foodinsecurity in the past 30 days, significantly higher than the 12-month experiences reported for 2017-18 when 11 per cent of households were food insecure. Households with children were more likely to be food insecure than households without children.

- COVID-19 has had a major or a moderate impact on the ability of some families to meet their financial obligations or essential needs. In a crowdsourcing survey conducted in late-May and early-June, 44 per cent of persons who identified as Arab reported these impacts, as well as 43 per cent of persons identifying as Filipino, 42 per cent of persons identifying as WestAsian, 40 per cent of persons identifying as SoutheastAsian and 39 per cent of persons identifying as Black, compared to 25 per cent of persons identifying as Japanese, 27 per cent of persons identifying as Chinese, and 23 per cent of persons identifying as White.

Government Response To Date

- $50 million to support Canada’s immediate health response to COVID-19.

- $1 billion COVID-19 Response Fund, including funding for the provinces and territories and Indigenous communities for health research, and for the World Health Organization and other international partners.

- $2 billion to procure personal protective equipment and supplies for health care workers.

- Canada Child Benefit top-up payment in May 2020 of up to $300 per child.

- $240.5 million to develop, expand and launch virtual care and mental health tools to support Canadians.

- $157.5 million through the Reaching Home initiative to support people experiencing homelessness during the COVID-19 outbreak.

- $350 million to establish an Emergency Community Support Fund to support vulnerable Canadians through charities and non-profit organizations that deliver essential services.

- $7.5 million in funding to Kids Help Phone.

- Up to $114.9 million to support northern communities, including support for air carriers, enhanced food subsidies and other emergency health care preparations.

- Student loan repayments are suspended until September 30 and interest will not be charged to borrowers on their student loans from March 30 to September 30.

- $285.1 million to provide targeted increases in primary health care resources for First Nations communities.

- $270 million to supplement the On-reserve Income Assistance Program.

- $500 million Emergency Support Fund to help cultural, heritage and sport organizations.

- $9 million through United Way Canada for local organizations to support seniors.

- $20 million for expanding the New Horizons for Seniors Program to reduce seniors’ isolation, improve seniors’ quality of life, and help them maintain a social support network.

- $100 million to the Canadian Red Cross to enhance their response capacity and to support public health efforts.

- $380 million for an Indigenous Community Support Fund to address immediate needs in Indigenous communities.

- $2.5 billion for a one-time payment of $300 for all seniors eligible for the Old Age Security pension, and an additional $200 for seniors eligible for the Guaranteed Income Supplement.

- Facilitating mortgage payment deferrals of up to six months between creditors and debtors.

- One-time payment for certificate holders of the Disability Tax Credit.

- Special GST Credit top-up payment for low- and modest-income families. The average additional benefit was close to $400 for single individuals and close to $600 for couples.

- $100 million to support food banks and other organizations providing hunger relief.

Gender Equality Around the World

Promoting gender equality to build a more peaceful, inclusive, rules-based and prosperous worldGender Results

FrameworkKey Indicators of the Impact of COVID-19

- ILO reports that women perform three times more unpaid care work than men. This is likely to have increased as schools and child care services closed and women took on more child care and teaching duties, and as more meals needed to be cooked at home.

- UNFPA estimates that 47 million women in 114 low- and middle-income countries may not be able to access modern contraceptives and 7 million unintended pregnancies are expected to occur if the lockdown carries on for 6 months and there are major disruptions to health services.

- Past experience shows that domestic, sexual, and gender-based violence increases during public health and economic crises and disasters. UNFPA estimates that there will be an additional 31 million cases of gender-based violence if the lockdown continues for at least 6 months.

- Women make up 70 per cent of health care workers around the world, and even higher shares of care-related occupations, such as nursing, midwifery, and community health care, all of which put them at greater risk of contracting COVID-19 due to close contact with patients. Low pay and poor working conditions exacerbate the risks these workers face.

- Women’s mentalandemotionalhealth has been disproportionately affected during COVID-19.

- COVID-19 also directly impacts womenandchildrenfleeingviolencein conflict settings. For example, according to UNICEF, millions of children in Yemen will be pushed to the brink of starvation as a result of the shortfalls in humanitarian aid funding amid the COVID-19 pandemic.

Government Response To Date

- Allocating $442.4 million, as well as another $50 million announced as part of the COVID-19 Response Fund, to support international efforts to fight the COVID-19 pandemic and investing in line with the feminist international assistance policy. This funding will support the development and distribution of vaccines and treatments, including through the Access to COVID-19 Tools Accelerator initiative and the Coalition for Epidemic Preparedness Innovations. The funding will also support COVID-19 international humanitarian appeals, country-specific requests for assistance, and, the enhancement of regional pandemic responses for African countries while focusing on key thematic areas such as reproductive health and rights.

GBA+ Highlights of Canada’s COVID-19 Economic Response Plan

The government recognizes that all Canadians have been affected by COVID-19, but that vulnerable groups have experienced some of the most significant health, social and economic impacts. Canada’s COVID-19 Economic Response Plan was designed to provide rapid support that targeted those who need it the most. See Annex 1 for a detailed GBA+ Summary of each of the measures included in the Plan. The following analysis provides a brief summary of some of the aggregate GBA+ impacts of the Plan as a whole. Liquidity measures are excluded from this analysis as this form of support is not directly comparable to direct measures.

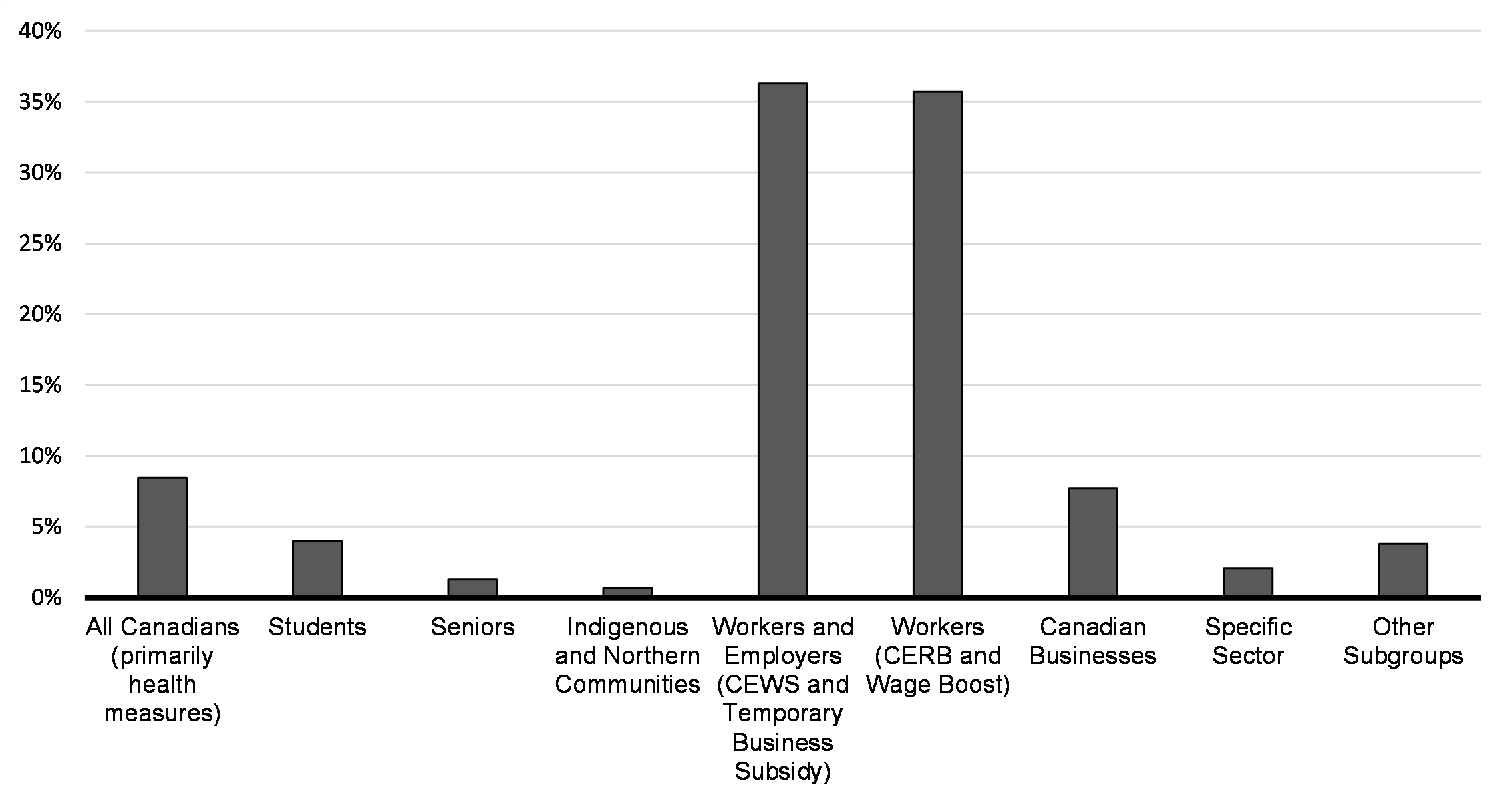

When categorized according to target group, to date, 18 measures, representing 8 per cent of the value of the Plan (Chart 1.6), are intended to directly benefit all Canadians, including the Support for the Canadian Red Cross and virtual care and mental health tools for Canadians. Workers as well as workers and employers are the target group for 3 measures each, for a combined total of 6 measures and 72 per cent of the value of the response package. 13 measures, representing 10 per cent of the response package value, are aimed at Canadian businesses and specific sectors. An additional 31 measures, representing 10 per cent of the value of the response, are aimed at particular groups, such as Indigenous peoples, students, seniors, and persons with disabilities.

Chart 1.6

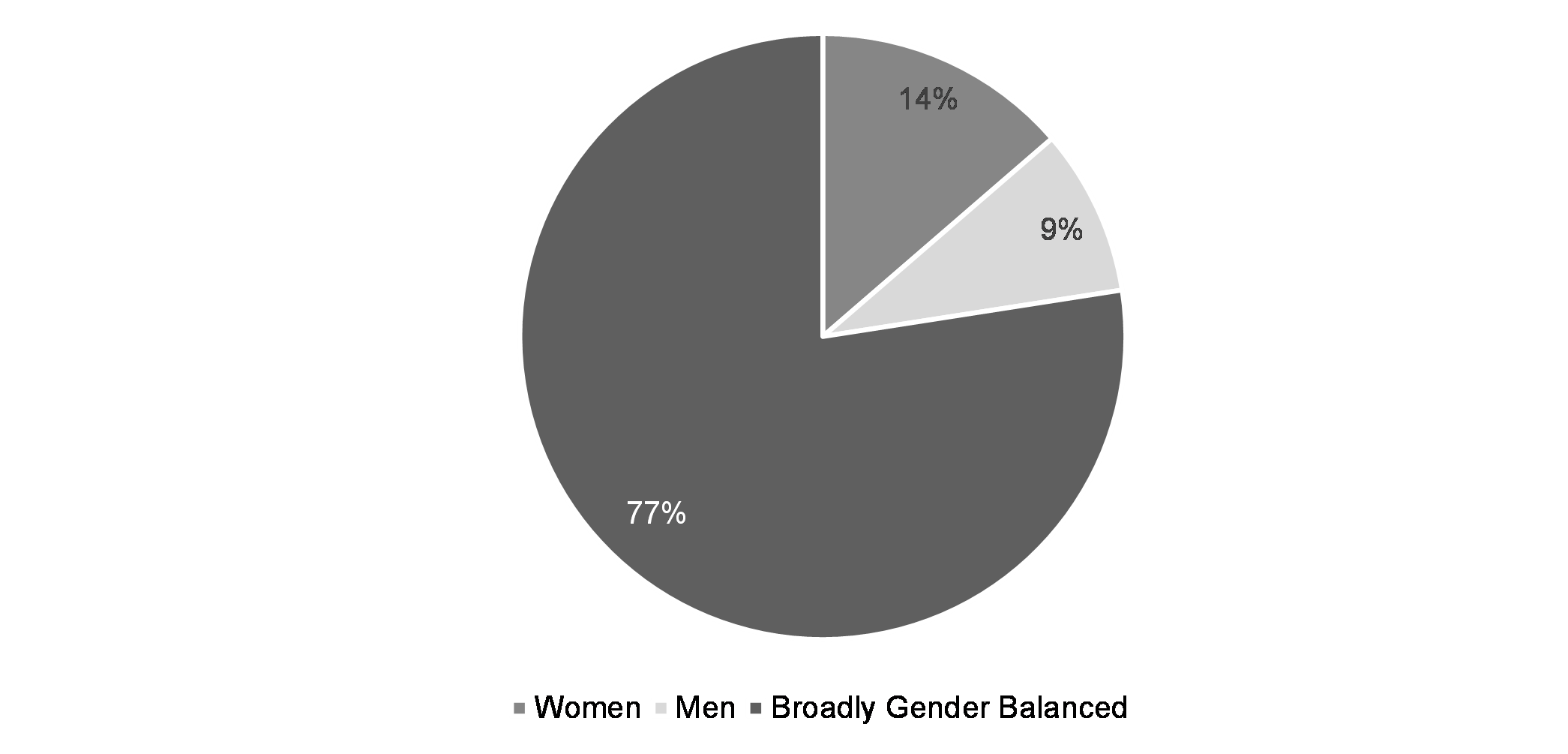

The majority of measures in the Plan carry direct benefits that are expected to be broadly felt by men and women in equal proportions (Chart 1.7). Nonetheless, women and men were disproportionately represented in the benefitting group for 14 per cent and 9 per cent of the value of the Plan, respectively. For example, the Essential Workers Wage Top-Up is expected to mostly benefit Canadians working in essential services, who are primarily women. In particular, at the national level, Statistics Canada data indicate that women represent 80 per cent of healthcare workers and more than half of retail and accommodation and food services workers. In contrast, support for those experiencing homelessness is expected to disproportionately benefit men as 64 per cent of persons experiencing homelessness in 2018 were men.

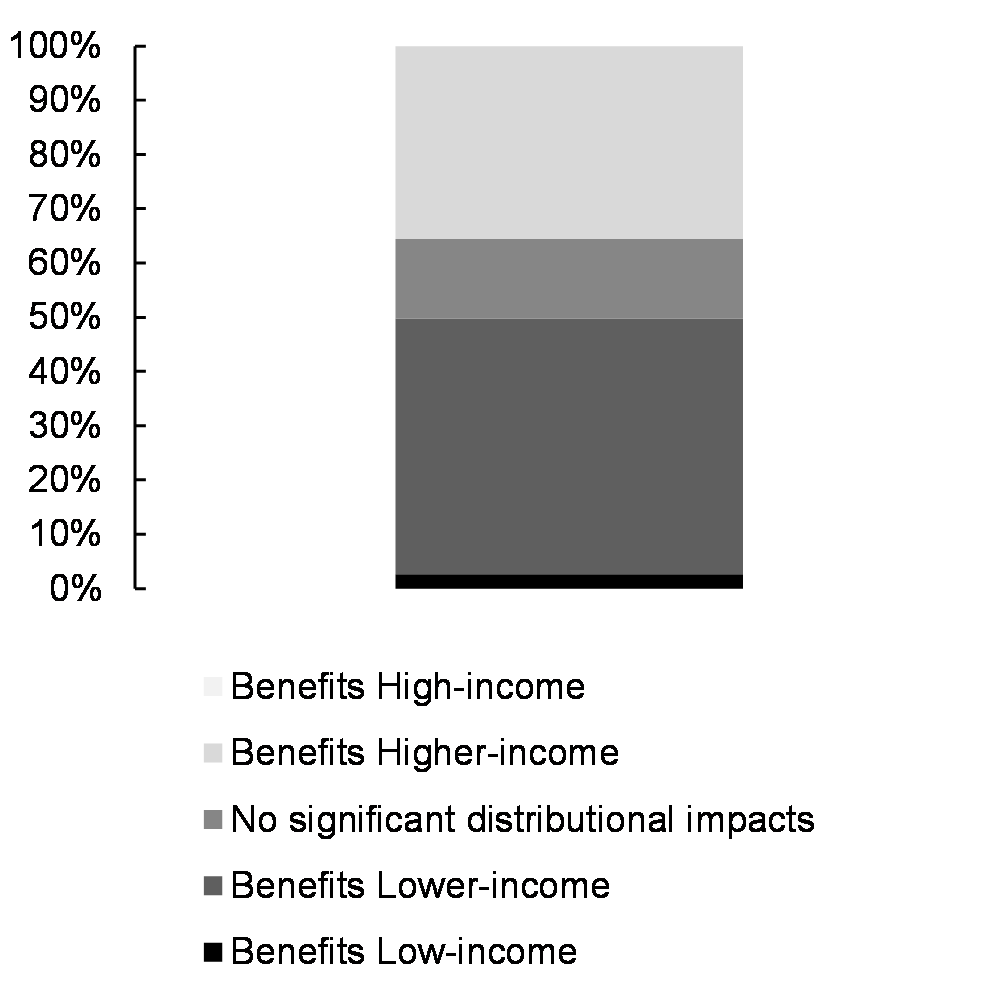

Chart 1.7

COVID-19 has disproportionately affected low-income Canadians. That is why the Plan proposes a number of measures which are directly targeted at lower-income Canadians (Chart 1.8). This includes the Surplus Food Rescue Program which benefits Canadians that rely on social assistance or disability-related income support and who may rely on hunger relief organizations such as food banks. Similarly, the primary beneficiaries of temporarily enhancing the GST Credit are individuals and families with low and modest incomes who were already receiving the status quo GST Credit. Seniors and single parents – single mothers in particular – benefit from this measure at a higher rate than the general population due to their lower average incomes. In contrast, other measures have characteristics that make them more likely to benefit higher-income Canadians, such as the business income tax payment deferral.

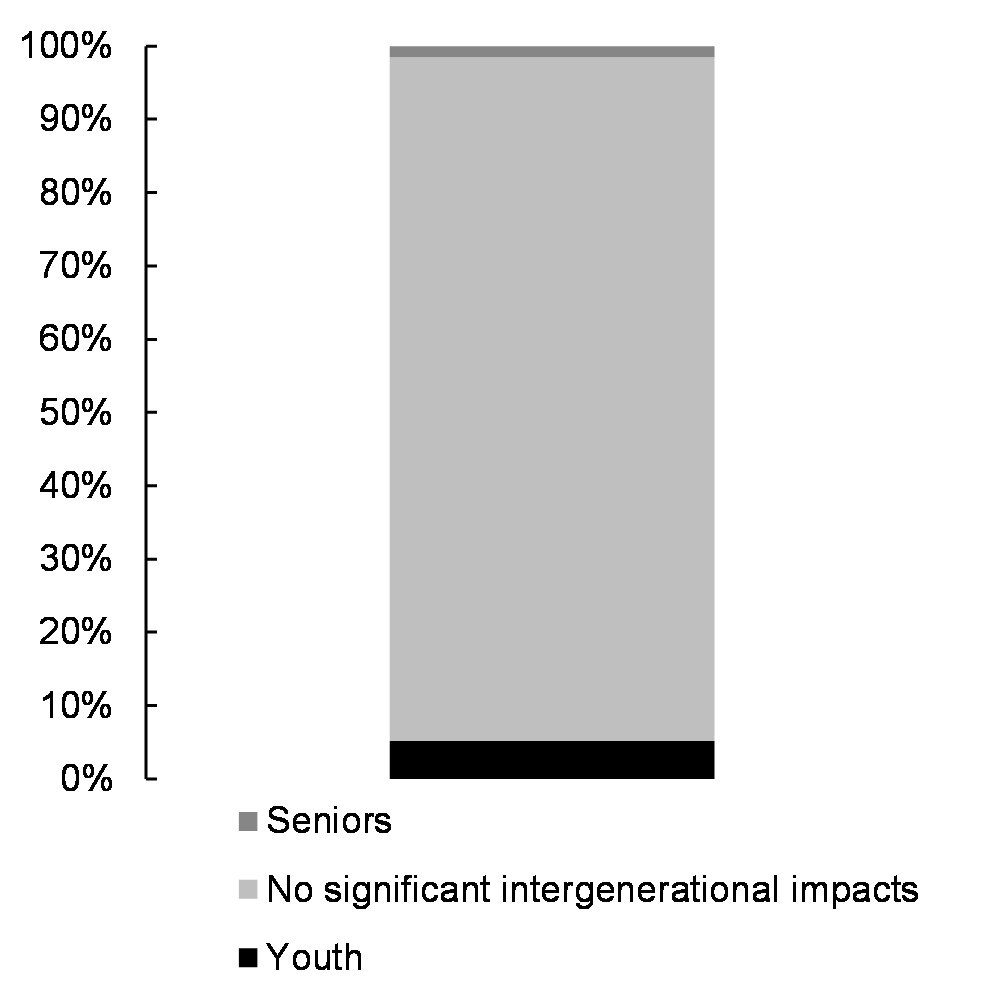

While older generations are at higher risk of health implications as a result of the pandemic, younger generations have been affected disproportionately financially and in terms of employment opportunities.

Chart 1.8

Accordingly, although 93 per cent of the Plan’s value benefits all age groups, 8 measures target youth specifically, representing 5 per cent of the value, while 7 measures are targeted at seniors, representing 1 per cent of the value. For example, the Canada Emergency Student Benefit provides income support to eligible post-secondary students and recent graduates facing financial difficulties who are unable to find work or unable to work due to COVID-19. Similarly, the New Horizons for Seniors Program is designed to ensure that seniors benefit from, and contribute to, the quality of life in their communities through social participation and active living. This specific investment is meant to help address social vulnerabilities created by COVID-19 and beneficiaries will tend to be relatively more vulnerable seniors, including low-income seniors and seniors with disabilities.

GBA+ Summary of the CERB and CEWS

Of all the measures announced to date as part of the Plan, the Canada Emergency Response Benefit (CERB) and the Canada Emergency Wage Subsidy (CEWS) are two of the most important in supporting a wide range of Canadians through COVID-19. The impacts these measures have had on diverse groups of Canadians are summarized here. The GBA+s for the remaining COVID-19 response measures are summarized in Annex 1.

Canada Emergency Response Benefit (CERB)

GBA+ timing

Mid-pointTarget population

Workers Affected by COVID-19Expected Direct Benefits Gender

○─○─●─○─○

Benefits

Men – WomenIncome

○─●─○─○─○

Strongly Benefits

Low – HighAge

○──●──○

Benefits

Youth – SeniorsThe CERB provides direct income support to Canadians of working age who have stopped working or whose works hours have been reduced due to COVID-19.

Although this measure was not designed to target a specific demographic or group, the CERB is benefitting those disproportionately affected by COVID-19 including lower-wage and young workers as shown in Chart 1.9 and described below.

Chart 1.9

Canada Emergency Wage Subsidy (CEWS)

GBA+ timing

Mid-pointTarget population

Workers and Employers affected by COVID-19Expected Direct Benefits Gender

○─○─●─○─○

Benefits

Men – WomenIncome

○─○─○─●─○

Strongly Benefits

Low – HighAge

○──●──○

Benefits